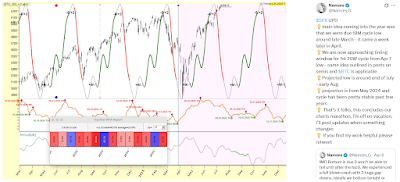

After the 20% pullback in the S&P 500 that occurred from February 19 to April 8, May, June, and July each posted positive returns of 6.2%, 5.0%, and 2.1%, respectively. In the 75 years following 1950, there have only been 17 instances in which the traditional "Sell in May and Go Away" period was marked by three consecutive positive months (May, June, and July):

From October 12 to October 27, the performance was 2 wins to 15 losses, with an average loss of 3.0%.

From October 27 to January 18, the record was 17-0, with an average gain of 7.1%.

Looking at the

following 12 months, from August through July, the outcome was

favorable, with a record of 14 wins and 3 losses in this setup. The

average gain over this period was 12.6%, compared to a more typical

yearly gain of 9.5%.

Interestingly, the only negative month

during the following year was October. Specifically, from October 12 to

October 27, the performance was 2 wins to 15 losses, with an average

loss of 3.0%. However, from October 27 to January 18, the trend

reversed dramatically, posting a perfect 17-0 record with an average

gain of 7.1% over 11.7 weeks.