The S&P 500 heads into Q4 with strong momentum after setting September all-time highs, a rare event that has almost always preceded year-end rallies.

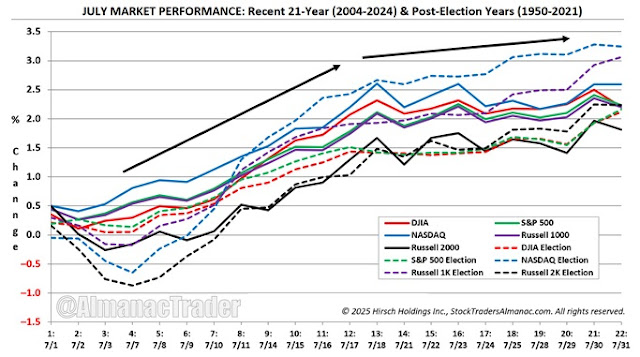

Post-Election Year most bullish in 4-Year Presidential Cycle since 1985.

The post-election year is historically the most bullish phase of the four-year cycle, and 2025’s unusually strong May–October stretch strengthens the case for further gains.

No losses in Q4 and up >5% since 1950.

October’s volatility often marks a final shakeout before the market’s “Best Six Months” (November–April) and the NASDAQ’s “Best Eight Months” (November–June). These periods, long captured by tactical switching strategies, have consistently outperformed and now align with a market already in record territory.

Recent pullbacks tied to AI earnings and fiscal risks have been shallow, leaving breadth and trend intact. With growth solid, inflation contained, and policy bias shifting toward support, the seasonal and macro backdrop favors continuation of the bull run. We project the S&P 500 to reach 7,100 by year-end, a gain of roughly 20 percent.

See also:

.PNG)