Since 1990, the Friday of July’s monthly options expiration week has shown a bearish bias for the DJIA, which declined 21 times in 35 years, with two unchanged years—1991 and 1995. On that Friday, the average loss is 0.36% for the DJIA and 0.35% for the S&P 500.

Showing posts with label Steve Miller. Show all posts

Showing posts with label Steve Miller. Show all posts

Saturday, July 12, 2025

Seasonal Weakness in US Stocks During July Options Expirations | Jeff Hirsch

Labels:

4 Year Cycle,

Branimir Vojcic,

Data Mining,

Jeffrey A. Hirsch,

Namzes,

Post-Election Year Pattern,

Presidential Cycle,

S&P 500 Index,

Seasonality,

Steve Miller,

US-Stocks

Friday, April 4, 2025

Second Week of April Up 72% of the Time | Paul Ciana

Bank of America

technician Paul Ciana notes that while April has historically been a

strong month, "over the last ten years, the SPX trended down in April

and bounced back in May," but week 2 of April has been up 72% of the

time.

BoA Paul Ciana: Week 2 of April up 72% of the time.

S&P 500 (30-Minute Bars).

Hurst's nominal 10-Day Cycle points to a low on Tuesday, April 8 around 8:30 a.m.

Week 3 of the 3-Week Cycle (click HERE).

42-Month Kitchin Cycle, 18-Month Cycle, Premium-Discount Levels, and Buy Zone.

Please note, David Hickson expects the current 18-Month Cycle to bottom around May-June;

three monthly pushes from the breakout to the downside (click HERE).

CNN Fear & Greed Index: Extreme Fear.

April 4, 2025 @ 4.27 = lowest since May 11, 2022 @ 4.03.

And finally, the Ultra Bear Perspective:

» Stop trying to buy the dips. The S&P 500 still has 1500-2000+

points of downside left over the next 2-3 years. «

Trigger Trades, April 4, 2025.

points of downside left over the next 2-3 years. «

Trigger Trades, April 4, 2025.

Labels:

10-Day Cycle,

3 Day Cycle,

3 Month Cycle,

3 Week Cycle,

BOA,

Cycles,

David Hickson,

J.M. Hurst,

Neil Sethi,

Paul Ciana,

S&P 500,

Steve Miller,

Three-Push Patterns,

US-Stocks

Thursday, December 5, 2024

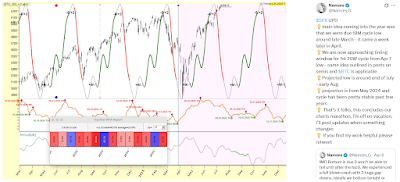

S&P 500 Cycle Analysis - Time and Price Projections Update | Steve Miller

In early November, both small caps and mid caps took the lead, but they have since paused. Recently, the mega caps have regained leadership, with Apple, Google, Meta, and Microsoft all making sharp moves to the upside. This has contributed to a recent uptick in the S&P 500. On the upside, we have short term resistance levels between 6,073 and 6,176.

The next 20 trading day cycle low is expected on December 7 (±3 trading days), and the dominant cycle trough is due in late May to June of 2025. The market is clearly in a rising phase, with the weekly trend firmly up. Only a drop below the 5,700 low would shift the market from a bullish cycle structure to a bearish one. On the short-term S&P 500 chart, the current setup resembles Apple’s chart: a bullish, right-hand translation throughout nearly the entire rally.

Now there is this very narrow window around December 7 for a pullback. The downside base case would be between 6,025 and 5,963, followed by another move to the upside for a higher high. Overall, this remains a very bullish market during a bullish seasonal period, and fading the trend is not advisable at this time.

Labels:

Cycle Analysis,

David Hickson,

J.M. Hurst,

S&P 500,

Seasonality,

Steve Miller,

US-Stocks

Thursday, November 21, 2024

Thanksgiving to Santa Claus Rally Trade │ Jeff Hirsch

Thanksgiving [Thursday, November 28] kicks off a run of solid bullish seasonal patterns. November-January is the year’s best consecutive 3-month span (2025 STA p. 149). Then there’s the January Effect (2025 STA p. 112 & 114) of small caps outperforming large caps in January, which begins in mid-December.

And of course, the "Santa Claus Rally," (2025 STA p. 118) invented and named by Yale Hirsch in 1972 in the Almanac. Often confused with any Q4 rally, it is defined as the short, sweet rally that covers the last 5 trading days of the year and the first two trading days of the New Year. Yale also coined the phrase: "If Santa Claus should fail to call, bears may come to Broad and Wall."

We have combined these seasonal occurrences into a single trade: Buy the Tuesday before Thanksgiving and hold until the 2nd trading day of the New Year. Since 1950, S&P 500 has been up 79.73% of the time from the Tuesday before Thanksgiving to the 2nd trading day of the year with an average gain of 2.58%. Russell 2000 is up 77.78% of the time since 1979, average gain 3.34%.

» Buy the Tuesday before Thanksgiving and hold until the 2nd trading day of the New Year. «

And of course, the "Santa Claus Rally," (2025 STA p. 118) invented and named by Yale Hirsch in 1972 in the Almanac. Often confused with any Q4 rally, it is defined as the short, sweet rally that covers the last 5 trading days of the year and the first two trading days of the New Year. Yale also coined the phrase: "If Santa Claus should fail to call, bears may come to Broad and Wall."

We have combined these seasonal occurrences into a single trade: Buy the Tuesday before Thanksgiving and hold until the 2nd trading day of the New Year. Since 1950, S&P 500 has been up 79.73% of the time from the Tuesday before Thanksgiving to the 2nd trading day of the year with an average gain of 2.58%. Russell 2000 is up 77.78% of the time since 1979, average gain 3.34%.

Reference:

Jeffrey A. Hirsch (November 20, 2024) - Feast On Small Caps Thanksgiving to Santa Claus Rally Trade.

Jeffrey A. Hirsch (November 20, 2024) - Feast On Small Caps Thanksgiving to Santa Claus Rally Trade.

» From November 5 to December 31, the average return of the S&P 500 has been 2.68%; Nasdaq 100 5.53%,

and Russell 2000 5.7%. In election years S&P 500 3.38%; Nasdaq 100 0.79%, and Russell 2000 7.94%. «

See also:

Labels:

J.M. Hurst,

Jeffrey A. Hirsch,

Nasdaq 100,

Russell 2000,

S&P 500,

Santa Claus Rally,

Scott Rubner,

Seasonality,

Steve Miller,

Thanksgiving,

US-Stocks

Monday, November 4, 2024

S&P 500 vs VIX Put/Call Ratio | Jason Goepfert

Volume in VIX puts was more than two times that of calls on Friday.

That's one of the highest turnovers in 15 years.

It has typically spiked at times of extreme anxiety.

Jason Goepfert, November 4, 2024.

That's one of the highest turnovers in 15 years.

It has typically spiked at times of extreme anxiety.

Jason Goepfert, November 4, 2024.

Preliminary CBOE Put/Call Volume Ratio on Nov. 4 at 2PM ET

is officially "pretty far up there".

Labels:

Cycles,

J.M. Hurst,

Jason Goepfert,

Put/Call Ratio,

S&P 500,

Sentiment,

Steve Miller,

Tom McClellan,

US-Stocks,

VIX

Friday, October 25, 2024

S&P Cycle Analysis - Time and Price Projections Update | Steve Miller

The upcoming week marks the pre-election period, where heightened election anxiety and a significant earnings schedule are expected to drive high volatility. This trend is likely to continue through election day. Historical analysis shows that the September to November timeframe has often been associated with increased risk, frequently leading to substantial market corrections.

SPY (weekly bars), the MACD, and the extreme stretch between the 13-week and 89-week

moving averages, which historically always leads to extended corrections.

Stocks have demonstrated remarkable resilience, displaying behavior that can be characterized as extreme. The above weekly chart of the SPY highlights this dynamic, tracking the moving average convergence divergence (MACD) alongside the distance between the 13-week and 89-week moving averages. Currently, the MACD indicates an unusually wide gap between these averages, suggesting a potential correction on the horizon.

When such corrections occur, they can be quite severe. Although the market has remained strong, November and December are anticipated to experience downturns due to the current extremes, which could lead to several challenging weeks ahead. Nevertheless, broader analysis suggests that the bull market may extend into 2025 before facing a significant downturn, potentially resulting in years of low or negative returns in the stock market.

SPY (weekly bars), six-month cycles, three-month cycles.

When such corrections occur, they can be quite severe. Although the market has remained strong, November and December are anticipated to experience downturns due to the current extremes, which could lead to several challenging weeks ahead. Nevertheless, broader analysis suggests that the bull market may extend into 2025 before facing a significant downturn, potentially resulting in years of low or negative returns in the stock market.

SPY (daily bars) and 21-trading day cycles with projected ideal troughs around

November 6 (Wed) and December 4 (Wed), with a margin of ±3 trading days.

An examination of the SPY across various timeframes, including weekly and two-hour metrics, reveals a deterioration in the two-hour indicators, often the first sign of an impending correction. Historical examples, such as the market's reaction following the 2016 Trump election, highlight the potential for volatility. On that occasion, the Dow fell nearly 800 points before rebounding. Similar large movements are anticipated in the days leading up to and following this forthcoming election. While signs of a downturn have been expected for weeks, the market continues to set the course, underscoring its ultimate authority.

Reference:

Steve Miller (October 25, 2024) - S&P 500 Cycle Analysis - Time and Price Projections Update (video)

Steve Miller (October 25, 2024) - S&P 500 Cycle Analysis - Time and Price Projections Update (video)

Labels:

2024 United States Presidential Election,

4 Year Cycle,

Cycle Analysis,

David Hickson,

Inflation,

J.M. Hurst,

Presidential Cycle,

Ryan Detrick,

S&P 500,

Seasonality,

SPY,

Steve Miller,

US-Stocks

Saturday, October 19, 2024

S&P 500 Cycle Analysis - Time and Price Projections | Steve Miller

SPX (monthly bars)

SPY (weekly bars)

SPY (daily bars)

SPX (daily bars): ideal 21 Trading Day cycle trough November 6 (Wed) ± 3 days.

Looking at weekly, daily, and intraday charts, our proprietary indicators indicate a strong bullish sentiment, with the SPY, and QQQ showing very bullish trends. While corrections are often anticipated, the market conditions do not suggest a need to short at this time. The S&P weekly chart remains strong, showing no signs of a peak yet. Although historical valuations are high, there is currently no indication of an impending downturn.

However, we also need to consider potential downside projections. While the market is currently strong, indicators and cycles suggest that we should be cautious as we approach the election period. We anticipate a pullback of approximately 6-10%, with the potential to reach new highs afterward. While cyclical patterns indicate possible declines in Q3 or Q4, our analysis suggests that major corrections might be more pronounced in November or December.

We are experiencing an elevated VIX during a strong market, likely due to geopolitical tensions and the upcoming elections. Historically, such an elevated VIX during bullish trends raises questions about potential market peaks and whether investors are hedging against upcoming volatility. The cycles suggest that implied volatilities might rise sharply post-election, possibly reaching the mid-30s or higher.

However, we also need to consider potential downside projections. While the market is currently strong, indicators and cycles suggest that we should be cautious as we approach the election period. We anticipate a pullback of approximately 6-10%, with the potential to reach new highs afterward. While cyclical patterns indicate possible declines in Q3 or Q4, our analysis suggests that major corrections might be more pronounced in November or December.

We are experiencing an elevated VIX during a strong market, likely due to geopolitical tensions and the upcoming elections. Historically, such an elevated VIX during bullish trends raises questions about potential market peaks and whether investors are hedging against upcoming volatility. The cycles suggest that implied volatilities might rise sharply post-election, possibly reaching the mid-30s or higher.

Reference:

Labels:

Cycle Analysis,

J.M. Hurst,

S&P 500,

Seasonality,

Steve Miller,

US-Stocks

Friday, April 26, 2024

S&P 500 Cycle Analysis | Steve Miller

Labels:

Cycle Analysis,

J.M. Hurst,

S&P 500,

Steve Miller,

US-Stocks

Subscribe to:

Comments (Atom)