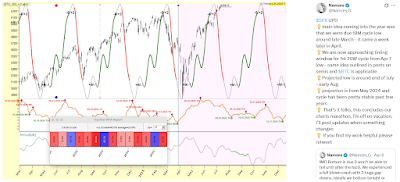

My base case for 2026 is a sharp but ultimately corrective bear market—approximately a 25% drawdown—followed by a meaningful recovery into year-end. Structurally, I expect a classic sequence: an early-year head fake, a multi-month liquidation phase, and a strong fourth-quarter rally.

2026 Forecast for the S&P 500 (green line):

■ Rally into ~Feb 17 toward 7,250–7,400; topping risk, minor low ~Mar 27.

■ Acceptance below 6,532 confirms top; 6,144 next, then risk to low-5,000s.

■ Cycle lows: Jul 24 (major low, sharp rally) and Oct 27 (3.5Y trough, cleaner divergent entry).

■ Downside ~5,200 (4,600–4,800 extreme), followed by Q4 rally to ~5,950.

■ The bullish advance should extend into mid-February, with the S&P 500 potentially pushing into the 7,250–7,400 zone. Up to approximately February 17, the trend should remain constructive, but I will be watching closely for topping signals and negative divergences as that window approaches. A minor corrective low is likely around March 27.

■ The first serious warning that the market has topped will be acceptance below 6,532. If that level gives way, the next downside objective is 6,144. A sustained break below 6,144 materially increases the probability of a deeper liquidation that carries the index into the low-5,000s.

■ I am focused on two potential windows for a major cycle low: July 24 and October 27, the latter aligning with a projected 3.5-year cycle trough. My expectation is that July produces an important low, followed by a sharp rally. However, the more attractive risk-adjusted opportunity may come in October, where a lower low accompanied by positive divergence would offer a cleaner and more durable entry.

■ In terms of price targets, my central downside objective is near 5,200. In an extreme scenario, the lower bound of the range would be 4,600–4,800, while the upper bound of the bear-market low region sits around 5,400–5,600. From there, I expect a powerful fourth-quarter rally, with a year-end target near 5,950.

From a longer-term

perspective, the decennial pattern also supports this roadmap (see chart below). Year six

of the cycle is historically choppier. Across 23 prior observations, the

average profile shows a push higher into February, followed by a

volatile and corrective phase, and ultimately a year-end rally. As noted

in my 2025 forecast, year five is typically the strongest year of the

cycle; even after the spring 2025 crash, the market recovered

impressively, consistent with that tendency.

Dow Jones (monthly candles), 2023-2027.

» In my 2025 forecast, I noted that year five is typically the strongest year in the decennial cycle, and that even

after the spring crash the market recovered impressively. Year six, by contrast, is usually much choppier. «

Dow Jones (daily bars), 2025-2027.

» The de-trended decennial pattern, shown in grey with matching years in orange,

conveys the same structure: early advance, decline, consolidation, and a year-end rally. «

The

same decennial pattern, shown on a de-trended basis above, reinforces

this view. In the comparative analysis, the de-trended data appear in

grey, with selected analog years highlighted in orange. The message is

consistent across both views: an early advance, a meaningful decline,

extended choppiness, and a decisive rally into year end.

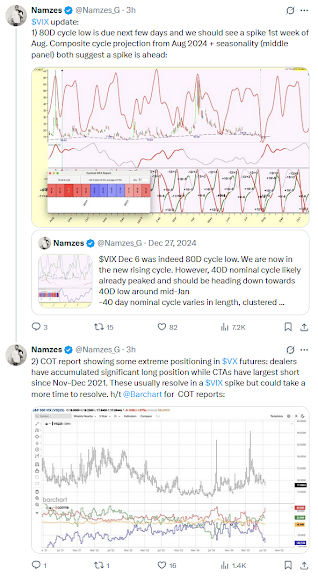

2026 Hurst Cycles Playbook for the S&P 500: Following the November 21 (Fri) 40-week cycle low and the December 19 (Fri) 40-day cycle higher-low confirmation, the S&P 500 is now in a new 40-week cycle uptrend. Though a 40-day cycle pullback is expected in late January, the rising 20-week cycle should drive the S&P 500 higher toward around the February 20 (Fri) option expiration.

Q1 rally, mid-year correction, July and October windows for yearly low, rally in Q4.

Building

on prior calls like the accurate November 2025 low, the chart above

illustrates July 2026 as an ideal nested low for multiple cycles

(20-week, 40-week, possibly 18-month and 3.5-year or 42-month).

Reference:

[Additional commentary and other asset forecasts will follow in the thread over the coming weeks.]

The 2026 Dollar Playbook.

See also: