The chart below shows 20-week and 40-week cycle price projections for S&P 500. Getting to the 7,200 area +/- may satisfy both targets. The black trendline resistance will get into the 40-week cycle target range late this year.

Cycle price projections are fully satisfied about 70% of the time. The probability of approaching them without fully satisfying them is considerably higher. However, this is not the time to be complacent as the stock market is most overvalued in more than 100 years.

The green rectangles depict blowoff top targets for Nasdaq-100 Index (NDX) for 20-week and 40-week cycles. The black count is preferred in which Primary wave 5, circle-5, will take the form of an ending diagonal, ideally into the green targets. The blue count is an alternative ending diagonal. In this count, NDX is now completing wave B of (4) with C expected in 2026 and (5) in late 2027 or early 2028.

The completion of circle-5 this year or in 2027/28 will mark the top of cycle degree wave V and super-cycle degree (III). Super-cycle (IV) can take about 15-20 years. Cycle a is expected in the early 2030s, then a bounce in cycle b, and then cycle c of (IV) in about mid-2040s. A typical retracement for (IV) is in the range of IV, i.e., the fourth wave of one lesser degree. That’s the long-term picture. The focus in the next twelve months will be on nailing the pending top and a cycle trough expected in mid-2026, +/-, which should be black circle-A or blue (4).

The completion of circle-5 this year or in 2027/28 will mark the top of cycle degree wave V and super-cycle degree (III). Super-cycle (IV) can take about 15-20 years. Cycle a is expected in the early 2030s, then a bounce in cycle b, and then cycle c of (IV) in about mid-2040s. A typical retracement for (IV) is in the range of IV, i.e., the fourth wave of one lesser degree. That’s the long-term picture. The focus in the next twelve months will be on nailing the pending top and a cycle trough expected in mid-2026, +/-, which should be black circle-A or blue (4).

traded fund (ETF) that tracks the performance of the financial sector within the S&P 500.

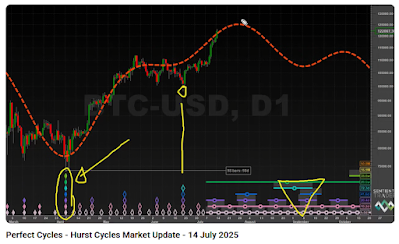

Rally still has room toward 6,700 (log 61.8%), even 6,800 (100% W1) in blow-off top scenario.

40-week cycle peak in late September to early October will mark a long-term market top.

40-week cycle peak in late September to early October will mark a long-term market top.

See also: