The 3 1/3 - Year Kitchin Cycle

Within the average 11.094-year sunspot cycle, there are shorter periods of solar prominence which occur every 40 or 42 months. These were first recognized in 1923 by the American economist Joseph Kitchin. They account for trade fluctuations and have a marked effect on terrestrial weather, alternating between hot and dry to cold and wet. Articles in Cycles magazine proclaim a 40.68-month cycle, an example of which follows:

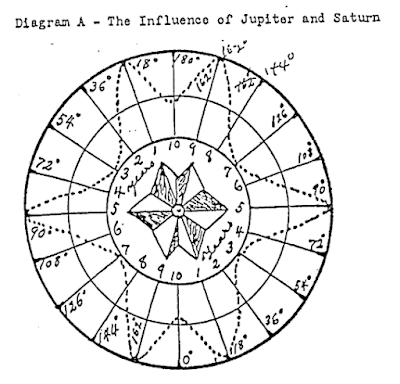

The planet Mars and the asteroid Vesta have a synodic cycle period of 4.17 years. (Mars often serves as a trigger planet to aspects of the heavier business planets (Saturn, Uranus, and Jupiter); Vesta has consistently been found in a prominent position in the natal horoscopes of stock traders.) The Dow is likely to peak at the first square (90-degree angle from the conjunction) between Mars and Vesta and to bottom at the second trine aspect (240-degree angle from the conjunction). Based on this, you should have bought May 28, 1985, and sold on December 7, 1987. (Ed. Note: October 19, 1987 was Black Monday. December would have been too late in this case.)

The 4 1/2-Year Martian Cycle

According to Lt.Comdr. David Williams, author of Financial Astrology (American Federation of Astrologers), the Mars/Jupiter 4 1/2-year cycle is one of the most dependable market indicators. Mars and Jupiter are in conjunction or opposition every 2.2353 years. Thus, every other conjunction is 4.4706 years, or approximately 234 weeks. Thomas Rieder, author of Astrological Warnings & the Stock Market (Pagurian Press), ties the 4 1/2-year cycle to the synodic period of Mars, The synodic period of a planet is the length of time elapsing between two successive conjunctions of that planet with the Sun as seen from Earth. Mars conjoins the Sun at intervals of about two years and three months, so this cycle is just twice the synodic period of Mars.

The 4-Year Presidential Cycle

The 3 1/3-, 4.17-, and 4 1/2-year cycles overlap and become what is sometimes referred to as the 4-year presidential cycle. It is theorized that the government stimulates the economy at election time to provide the illusion of prosperity and to insure the re-election of the President. However, closer analysis reveals that the cycle also exists in countries where elections are held every six or eight years or not at all.

Quoted from:

Carol S. Mull - Predicting the Dow.

In: Joan McEvers (Ed. 1989) - Financial Astrology for the 1990s.

Carol S. Mull - Predicting the Dow.

In: Joan McEvers (Ed. 1989) - Financial Astrology for the 1990s.

See also:

%20-%20Forecasting%20the%20NYSE.gif)