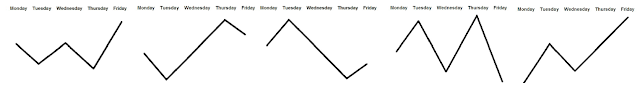

(I) The Classic Buy Day or Sell Day Template

This is the best template to make money since it is a wide range trending day that unfolds mostly on Monday, Tuesday and latest on Wednesday during the London session. The New York session will eventually give a retracement to continue with the trend that was set during the London session. The daily range will last for 7 to 8 hours once the profile is established.

▪ Always buy when the market drops at the right time of the day at key support level (buy below the opening price).

▪ On a buy day, if price starts by trading above the opening price, do not fall for that and wait for it to trade below the opening price.

▪ The faster the move to the support the good the trade, (it will look stupid and scary but buy when you see a fast move down to support).

▪ The distance from the open price to support will be 15 – 30 pips on average. If the move from open price to support in London session is more than 30 pips, wait for New York trade.

▪ If you can’t trade London session you can trade New York session to get in sync with London trade.

▪ Always take small profit of 20 – 30 pips at 12:00.

▪ The sell template will be vice versa of the buy template.

Mostly it will give a rally or drop from the daily opening price to the low or high of the day during the London session. The trend usually lasts into 11:00 EST.

(II) The London Swing to Z Day Template

This template is found in the middle of a larger price swing when the trend is exhausted after a large explosive move. It is a narrow range day and ideally occurs on Thursday.

▪ This

will unfold in the middle of a Larger swing (strong move has minor to

no retracement, most of the time price will consolidate after a strong

or very big move and this template will unfold).

▪ If you had 2 – 3 days of big move, expect a pause in price.

Price will initially drop below the opening price, then run above the opening price and go back to the range into consolidation. It first appears to unfold as the Classic Buy or Sell Template. But if it continues consolidating, do not look for continuation into the New York session. Take profits.

(III) The London Swing to New York Open / London Close Reversal Template

The bullish version of this template always begins like a Classic Buy or Sell template with a decline below the opening price before price starts rallying. Once price drops, a buy entry forms, price rallies to a higher time frame Point of Interest (POI). If this happens during the New York session, it indicates a classic market reversal.

▪ The reversal market profile is one that typically forms as a Key Reversal Day.

▪ It will form a sell day during a bullish Asian, London and Possibly into New York session but fails to hold its rally and reverse lower.

▪ The swing up will likely be the right shoulder of an inverted head and shoulders top on higher time frame or swing up to the higher time frame OTE.

▪ This move will many times look just like classic London open buy day. ▪ Many times at 18:00 GMT or even later the market will eventually consolidate into the new trading day.

▪ The reversal market profile will form a buy day during bearish Asian, London and possibly into New York session but fails to hold its lower price slide and reverse higher.

▪ The swing down will likely be the right shoulder of an inverted head and shoulders bottom on higher time frame or swing down to the higher time frame OTE.

▪ This move will many times look just like classic London open sell day.

The template is used to either reach for a bearish order block on a higher time frame, for a turtle soup raid or to close a range. On a bullish day it will first create an initial low of the day during the London session, run up and create the high of the day during the New York session around the London Close, then run back down and clear the initial low that was created during the London session. Ideally it can pan out after the market is in exhaustion based on the higher time frame's dominant trend.

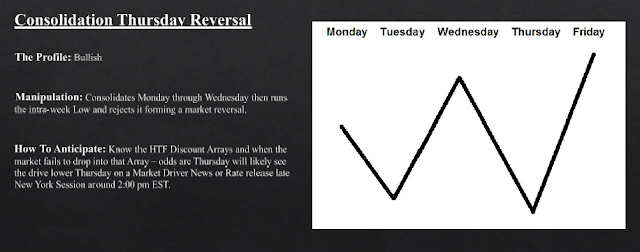

(IV) The Range to New York Open / London Close Rally Template

Generally this template is to be expected on days with high or medium impact news events like interest rate announcements, etc. Ahead of these events price will remain in consolidation during the Asian and London sessions. Lows will be cleared initially and after the news price explodes into a directional move.

▪ This pattern will unfold most often during the NFP, FOMC and Interest Rates Announcements.

▪ Before the News price will break London Lows and rally after News Release.

▪ Always remember to see cross pairs of the major pair you are trading when this template unfolds.

▪ If Dollar is dropping and EURUSD pair is consolidating EURJPY will be buying.

▪ If Dollar dropping, GBP is buying and EUR is consolidating, wait for GBP to hit resistance level and EUR will give nice range to New York Open/London Close rally setup.

▪ If majors are consolidating but crosses are moving, wait for the crosses to hit key Support/Resistance levels and come back to majors and trade to the direction of the crosses.

(V) The Consolidation Raid on News Release Template

Unfolding during the New York session on days with high impact news, mostly FOMC press releases. During and shortly after the news old highs and lows of prior consolidation levels will be taken out. Ideally buy when a low is taken out and sell when a prior high was breached.

▪ This pattern will unfold most often during the NFP, FOMC and Interest Rates Announcements.

▪ After opening price, market will consolidate before the News.

▪ During the News releases price will drop to induce traders and take stops (this move might not be that big below the consolidation but it has to break the consolidation).

▪ After clearing the stops and inducing, price will move into true direction.

▪ You have to identify Key support level or order block below the consolidation.

▪ See if price will reject at support/resistance within 5 minutes after News release, if it won’t reject then leave the trade because you might be wrong in your analysis.

News are used to Inject Volatility. One of the most difficult ways to trade is to try to trade the News Releases. The Internet is littered with so-called robots or programs designed to quickly give you trading profits on the knee-jerk reaction to the news. This is pure gambling. We can never know for sure what the numbers will be in the reports, we don’t guess. However, we can wait for the release and watch the reaction and many times a signal will form within 5 minutes after the news release. Many times price will trade counter direction to the intended news hawks.

(VI) The London Swing to Seek & Destroy Template

This is the kind of day that won’t make you money. The Market Makers clear intention is to take out both buyers and sellers. Initially it would give you a London Open opportunity and setup, but very likely that won’t come to fruition. The narrow range zig-zag template lasts throughout the New York session and will oftentimes create an inside day. The template is usually applied in the middle or at the end of a larger price swing.

▪ This template will unfold most often after a big move/swing or at the end of the price move (support/resistance).

▪ It is better to trade when a pair is in the middle of the range knowing it is going to support or resistance rather than trading a pair that is already in support/resistance because we don’t know if is going to hold the Support/Resistance or break it.