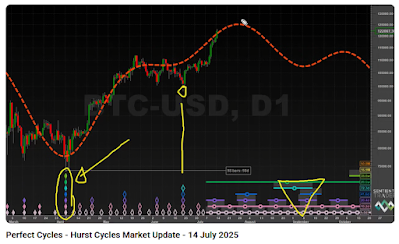

The chart below represents a dual Hurst cycle analysis of troughs and peaks in the 4-hour chart for Ethereum (ETHUSD). The orange line is the cycles composite, based on current estimates of periods, phases, and amplitudes.

Ethereum (4-hour bars) and Cycle Composite (orange line).

■ Next 40-week cycle peak (expected) late August or early September 2025.

■ Next 40-week cycle trough late 2025 or early 2026.

■ Next 18-month cycle peak in May 2026.

■ Next 18-month cycle trough September or October 2026.

■ Ethereum's bullish outlook from 2025 to 2028 predicts significant gains relative to Bitcoin.

■ Next 40-week cycle trough late 2025 or early 2026.

■ Next 18-month cycle peak in May 2026.

■ Next 18-month cycle trough September or October 2026.

■ Ethereum's bullish outlook from 2025 to 2028 predicts significant gains relative to Bitcoin.

Do not correlate price with the amplitudes of the cycle composite. Instead, use peaks and troughs as estimates of price turning points.

Reference:

Branimir Vojcic (August 11, 2025) - Ethereum Hurst Cycle Analysis: Key Turning Points for 2025-2026. (video)

Long-term Spectrum Cycle Composite for ETH.

Branimir Vojcic (August 11, 2025) - Ethereum Hurst Cycle Analysis: Key Turning Points for 2025-2026. (video)

Long-term Spectrum Cycle Composite for ETH.

Ethereum's 2016–2024 returns show Q1–Q2 strength (+20% avg monthly, May +36.48%, 55.56% positive), summer dips (Jun -5.84%, Sep -7.24%, 44.44% positive), and Q4 gains (+7.4% avg, 55–77% positive). Volatility: abs avg 20–30%, medians 4–5%.

Expectations for Remainder 2025 (Sep–Dec) and Q1-Q2 2026: Sep likely dips (-7.24%, 44% positive); Oct–Dec rebounds (+6–8%, 55–77% positive), possibly amplified by year-end sentiment. 2025 YTD momentum (+43.57% May, +41.22% Jul, +24.11% Aug) may soften Sep, but volatility (13–19% abs avg) warrants caution. Q1 2026 (Jan–Mar) rally (+17% avg, 66–78% positive); Q2 (Apr–Jun) strength Apr–May (+29% avg, 56–67% positive) then Jun dip (-5.84%, 44% positive), with ~+20% monthly early-year upside but high vol (20–30% abs avg).