Markets

typically shift from small ranges to larger trend moves. When the

market is in a large trend move, wait for it to settle into smaller

ranges before getting involved. This gives more reliable setups when the

market trends again. Market tops generally occur when the price closes

well off its low, while market bottoms happen when the price closes near

its low. Most traders get emotional during these times, buying at tops

and selling at bottoms. Once you understand this, it becomes easier to

make smarter trades.

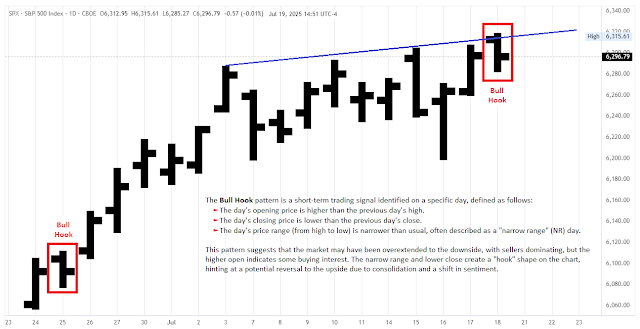

Small Ranges Beget Large Ranges. Large Ranges Beget Small Ranges.

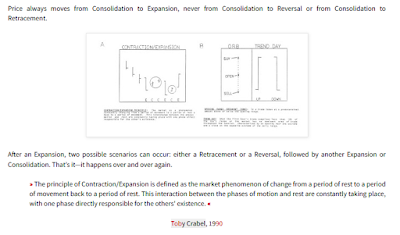

Markets

move from congestion to creation (expansion), transitioning from small

ranges to larger, more defined trend moves. A small range signals

buildup, and a large range signals an impending trend. If I see a small

net change from open to close, I know a large trend move is likely

coming and am prepared to act on it. Here’s

an example using the NASDAQ: Notice how volume

fluctuates throughout the day: heavy volume in the morning, a dip in the

middle, and a surge towards the end.

"U" shaped intraday: Heavy volume in the morning, a dip in the middle, a surge at the end.

This

pattern is consistent across markets. It’s like a freeway: traffic is

heavy in the morning, dies down in the middle of the day, and picks up

in the afternoon. Understanding this helps day traders identify

opportunities in the morning and towards the end of the day, while

avoiding the midday lull. Volume drives range, and large ranges happen

at the start and end of the day. This is when short-term traders make

money. We need volatility and large ranges to profit.

There are three key cycles in market behavior:

(1) small range/large range, (2) moving closes within ranges, and (3) closes opposite openings.

All three cycles work equally well in any timeframe and market.

"Do yourself a big favor: Mark off all the large-range days [in the chart above], and then study the size of the ranges just

prior to explosive up-and-down days. See what I see? We are given ample warning of virtually every large-range day

by the shrinkage of ranges a few days earlier."

The

key takeaway for short-term traders is that not every day offers a

high-probability trade. You need to identify days with potential for

explosive moves and not expect large profits daily. It’s about finding

that opportunity.

As

for market tops, they usually occur when prices close near their highs,

and bottoms happen when prices close near their lows. Focus on these

closing patterns to determine when to buy and sell.

Trend is a function of time. The more time in a trade, the more opportunity for trend.

The

most important insight in trading is that trends are the basis of all

profits. Without a trend, there are no profits. But what causes trends?

Trends are fundamentally a function of time—the more time you hold a

trade, the more opportunity for a trend to develop. The challenge with

day trading is that trends occur only about 15% of the time. Most of the

time, prices are consolidating, making it difficult to catch a big

trend move. Limiting yourself to a few hours of trading only targets

that small window when trends are likely to occur.

My Day Trade Secret: HTTC - Hold To The Close.

The

day trader dilemma is that they have limited time to catch trends.

Holding positions overnight allows you to capture longer trends and

larger profits. A small bet with the potential for a big move is the key

advantage of holding positions over time.

» How you know a large trend move is coming. «

Many day traders are afraid

to hold positions overnight. However, if you do the math, you'll see

that most market moves happen between the close of one day and the open

of the next. Moves within the day are often smaller and less reliable.

For short-term traders, the key to success is recognizing large range

days and holding positions to the close. This is how you catch a big

move during the day.

» Hold To The Close. «

S&P 500 E-mini Futures (daily bars).

Narrow Range 4 & 7 Days and Inside Bar Narrow Range 4 & 7 Days.

Narrow Range 4 & 7 Days and Inside Bar Narrow Range 4 & 7 Days.

See also:

%20-%20Full%203%20Day%20Cycle%20Trading%20System%20%5B56%20p.%5D-03.png)

%20-%20Full%203%20Day%20Cycle%20Trading%20System%20%5B56%20p.%5D-07.png)

%20-%20Full%203%20Day%20Cycle%20Trading%20System%20%5B56%20p.%5D-08.png)