Beginning on March 2 (Mon) (Trading Day 1), the US stock market historically follows two distinct paths. Over the recent 21-year period (solid lines in the chart below), March tends to open positively with modest gains through March 4 (Wed) (TD 3) before weakness leads to a sharp dip around March 9 (Mon) (TD 6). While indices typically move higher from March 16 (Mon) (TD 11), the NASDAQ and S&P 500 usually lead this recovery into the final close on March 31 (Tue) (TD 22).

March generally finishes positive across all major indices.

In contrast, Midterm Election years since 1950 (dotted lines) show significantly greater historical strength, potentially as a rebound from a typically tepid February. This cycle produces a front-loaded rally where R2K small caps flip from laggards to leaders, often outpacing S&P 500, DJIA, and NASDAQ. Strength generally persists until the Spring Equinox, reaching a seasonal peak on March 20 (Fri) (TD 15). After this point, indices tend to lose momentum and close out the month with choppy trading. Despite these differing mid-month trajectories, March has a 64% win rate, generally finishing positive across all indices.

Reference:

Detrended VIX Seasonality (see also HERE).

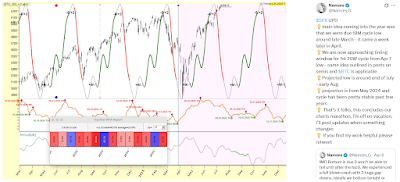

Bank of America's Bull & Bear Index hit 9.3 on February 24, crossing the contrarian "sell" threshold above 8, indicating excessive optimism among global fund managers. Historically, such readings preceded median three-month drawdowns of 5.5% for the S&P 500, and 8.6% for the Nasdaq.

See also:

.PNG)

.PNG)

.PNG)