Bank of America

technician Paul Ciana notes that while April has historically been a

strong month, "over the last ten years, the SPX trended down in April

and bounced back in May," but week 2 of April has been up 72% of the

time.

BoA Paul Ciana: Week 2 of April up 72% of the time.

S&P 500 (30-Minute Bars).

Hurst's nominal 10-Day Cycle points to a low on Tuesday, April 8 around 8:30 a.m.

Week 3 of the 3-Week Cycle (click HERE).

42-Month Kitchin Cycle, 18-Month Cycle, Premium-Discount Levels, and Buy Zone.

Please note, David Hickson expects the current 18-Month Cycle to bottom around May-June;

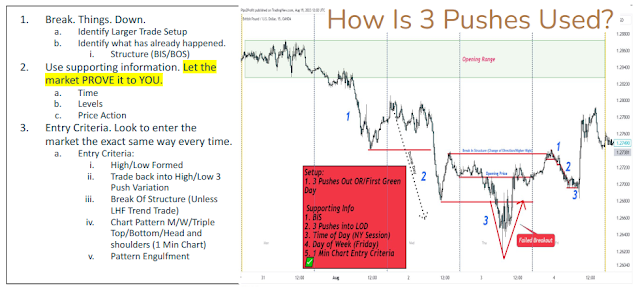

three monthly pushes from the breakout to the downside (click HERE).

CNN Fear & Greed Index: Extreme Fear.

April 4, 2025 @ 4.27 = lowest since May 11, 2022 @ 4.03.

And finally, the Ultra Bear Perspective:

» Stop trying to buy the dips. The S&P 500 still has 1500-2000+

points of downside left over the next 2-3 years. «

Trigger Trades, April 4, 2025.

points of downside left over the next 2-3 years. «

Trigger Trades, April 4, 2025.