Jeffrey A. Hirsch (Aug 23, 2023) @ X

Sunday, September 3, 2023

S&P 500 Pre-Election Year Seasonal Pattern 1949-2022 vs 2023 | Jeff Hirsch

Jeffrey A. Hirsch (Aug 23, 2023) @ X

S&P 500 Cycles Forecast | Sergey Ivanov

Monday, August 28, 2023

The S&P 7 vs the S&P 493 | The Kobeissi Letter

The Kobeissi Letter on X (Aug 28, 2023).

Friday, June 16, 2023

Pre-Election Year Seasonal Pattern of U.S. Stock Indexes | Jeffrey A. Hirsch

Reference:

Tuesday, March 14, 2023

Pump and Dump Patterns after Major News Release | Stacey Burke

See also:

Major Red News Calendar.

Wednesday, January 4, 2023

The Turn of the Year (TOY) Barometer | Wayne Whaley

What he found was there was a high correlation between the S&P 500’s returns between November 19th and the following January 19th and the S&P’s performance the 12 months following January 19. And since the 2-month period straddled the turn of the year and the gift giving season, he called it the TOY Barometer [...] if Nov 19 is on a weekend, use the Monday after the weekend, and if Jan 19 is on a weekend, use the Friday before). He only considered the price-only return (no dividends). If the return during this 2-month period was greater than 3%, a bullish signal was given, and the market was very likely to do well over the following 12 months. If the return was 0-3%, the signal was considered neutral, and results were somewhat random and in line with what is considered average. And if the return was negative, a bearish signal was given, and returns tended to be very poor.

Neutral Signals: There have been 19 neutral signals. The following year was positive 12 times (63%), compared to 73% win rate for “all years.” The overall average and median returns were 6.0% and 7.1%. But among the “up” years, the average and median gains were 14.4% and 9.4%, while the “down” years’ average and median losses were -8.5% and -7.8%. There were several big up years (1995, 1996, 1998, 2003), and two big down years (1973, 1977), so even if there is a neutral signal, there’s still a decent chance the following 12 months will venture far from its January 19 print.

Bearish Signals: There have been 16 bearish signals. Only 6 (38%) of the following years posted a gain while 10 posted losses – and 6 of those 10 posted double digit losses. The overall average and median returns were -3.6% and -6.0%. The “up” years posted average and median gains of 14.6% and 15.5%, while the “down” years posted average and median losses of -14.6% and -12.9%. So despite the low win rate, when the market does well, it has the ability to do very well, as was the case this past year.

[...] When a bullish signal is in play, odds heavily favor solid gains over the following 12 months, but when there’s a bearish signal, odds favor a down year with a relatively big loss. But regardless of the signal, “up” years tend to be very good.

Steve Deppe (Nov 19, 2015) - Maximizing Returns With Wayne Whaley’s TOY Barometer.

Steve Deppe (Jan 20, 2016) - Whaley’s “TOY Barometer” Sends Bearish Signal To Investors.

Taylor Dart (Jan 07, 2019) - S&P 500: One Study Worth Paying Attention To.

Seth Golden (Jan 19, 2021) - State of the Market: Historic Data Studies Offer A Guide.

Leavitt Brothers (2022) - Wayne Whaley's TOY Barometer.

Thursday, November 17, 2022

S&P 500 Performance by Weekday

Tuesday, September 27, 2022

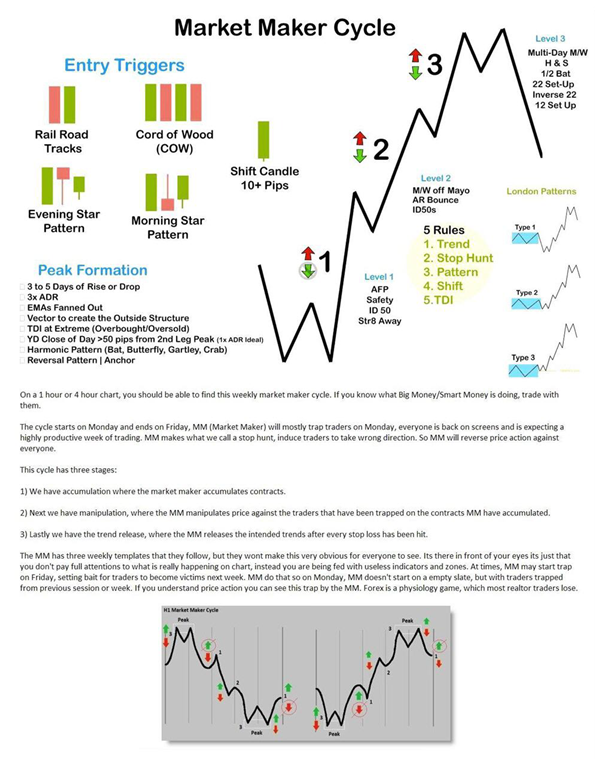

The Bullish & the Bearish Market Maker Cycle

- On day one the retail traders are selling and the institutions buying from the retail traders.

- On day two the retail traders are selling and again the institutions are buying.

- However, on day three the retail traders are again interested in selling and the institutions are buying up heavily.

- Now price moves up aggressively triggering stops and taking a profit. (In effect, the market makers are using a scaling-in method to book their profit).

- Following a Level III pullback price becomes choppy and continues because of what happens with the trader’s psychological adaptation to loss. After the market has run down for three days and traders have taken losses, these individuals react by pulling away from the market quite literally and having a few days off before coming back to trade. During this period the market is choppy and relatively stagnant until the traders have returned to play in the game again.

- "After a big drop the market must chop"

- "After three days of drop the market must chop"

- "After a big rise the market needs more guys"

- "After three days of rise the market needs more guys"

Count the levels to know what part of the cycle price is currently in. Entering trades at peak reversals is best. One should only take a long position when the Low of the Day (LOD) or High of the Day (HOD) is clear. This is the only place that has a high level of certainty in directional movement. Look for a midweek reversal which will generally correlate with one or both of the intraday reversals. With an awareness of the longer cycle and assuming one is in the correct place within the cycle, it is possible to convert a spot trade to a swing trade from one of the 3 day cycle peaks to the other given an appropriate entry. This would involve going from one peak formation high to the next peak low and may take several days.

On an intraday trade, it is still important to understand the current position within this larger cycle. This will help to make a judgement about how far a run may last. For example, if price has just passed the peak high and is at a Level I accumulation then an intraday long trade after a bearish stop hunt, while valid, will not be likely to produce consistent results. Hence, it is a good idea to not take trades against the longer trend at a Level I accumulation.

- Take out existing stops, that is: collecting buy side and sell side liquidity.

- Encourage traders to commit to positions in a direction that is opposite to where the real trend is going to be.

- The spread is opened up by a few pips. This allows traders orders to be triggered outside their normal boundaries and they will be holding negative positions from the outset.

- It is common to see price undergo a further period of accumulation lasting 30 to 90 minutes which encourages traders to take further positions. When there are enough positions, the price is moved in the direction of the true trend and their stops will be triggered.

- There is often a second move to the HOD/LOD though most of the time it will fail to take it out (so as to not give those who got in a profitable position to escape from). This forms the typical W or M pattern.

If a trade is taken in the area of the HOD/LOD one might notice that price is moving around but the position changes little. Looking at the price board one will see that it is "flickering red and blue" with lots of changes suggesting that there is lots of activity but in fact there is little and a reversal is imminent. Another observation during this period is that the spread widens. This is done so that a broader range of orders can be collected and accumulated during this period, making it even more difficult for traders to take profit as they are in a losing position right from the outset. The diagram below demonstrates what happens to the spread during this period.

Like before, this move will be in the 25 – 50 pip range and be comprised of 3 candles or 3 pushes. But also like before this is not necessarily the case and more or less are also possible. Again the trader must use their own judgement and discretion. Therefore, identifying that after a period of time the stop hunt has not led to a reversal one should scratch the trade. An appropriate period of time is 2 hours following the second leg of an M or W pattern. It the trader has not moved in the expected direction by this time, something is wrong and they have not been able to build up enough volume to make it worthwhile to reverse the market.

Saturday, July 30, 2022

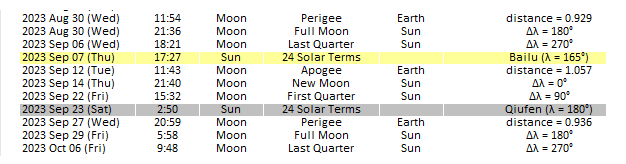

Trading the S&P 500 with the Lunar Cycle | Randall Ashbourne

[...] What I discovered was that, statistically, the old assertions not only hold up, but when traded consistently over time, produce big profits for small amounts of time exposed to market conditions [...] Buying a single share of the index at the closing price of our starting date on the January 4 New Moon and holding until the close of the June 1 Solar Eclipse New Moon, produced a profit of $44.35 - 3.49% (bottom left corner of the table).

[...] Staying OUT of the market during all New Moon-Full Moon phases would have protected us from losing some of our buy-and-hold gains … but delivered much better profits for our Loonytoons strategy by being profitable Short trades. We were in the market ALL the time, but continually reversing positions - to get three times the profit of buy-and-hold. The darker green coloring shows the very profitable trades, the light green shows profitable trades. The rose coloring shows that only ONE “assumed” Short phase would have resulted in a trading loss. But, remember … this is overall, taking into account the full 6 month period.

[...] take advantage of the Quarter Moon dates. So, our trading strategy now becomes to open 1 position at either the New Moon or Full Moon, but to add an extra position at the First Quarter or Third Quarter date. And the table below shows a significant boost to our potential profits: Instead of relying totally on the 14 day Short from NM-FM, we add one extra Short at the 1Q Moon - boosting the overall profit from Short trades from $46.61 to $109.36. And we adopt the same strategy when we reverse to Long trades at the Full Moon - 1 Long at Full Moon and one extra Long at 3Q Moon, boosting our Long profits to $152.56.

Tuesday, July 5, 2022

Inside Days in the S&P 500 │ Toby Crabel

Toby Crabel (1990) - Computer studies suggest that Inside Days (ID) provide very reliable entries in the S+P market. The data used in the studies is daily open, high, low and close prices from 1982 to 1987. All of the following patterns are defined for a computer but can be seen easily on a daily bar chart.

- Pattern (1) is simply an inside day followed by a sale (s) on a lower open or buy (b) on a higher open. Entry is on the open with an exit on the same day's close with no stop. This procedure produced sixty-eight percent winning trades with profits of $18,000 after an $18 commission. This is a reasonably high percentage and suggests a strong bias in the direction of the open after any ID.

- Pattern (2a) is defined as an ID with a higher close than the previous day followed by a higher open. A buy is taken on the open and exited on the close. The same is done on the sales (Pattern (2b)) if there was an ID with a lower close followed by a lower open. Again, stops were not used. There were forty-four trades as such with seventy-four percent of them profitable. Net profit was $14,914. The percentage has improved and profits are better per trade than Pattern (1). This supports the premise that the closing effects the next day's action and potential breakout. Further tests uncover some variations to above results. Although the opening direction after an inside day appears to be a valid indicator of upcoming direction, there are same specific patterns that show very high percentage profitability without the use of the previous day's closing direction. Specifically, two patterns; one a sale (Pattern (3)), one a buy (Pattern (4)).

- Pattern (3): The day of entry is called Day 1. The day of immediately preceding the entry is Day 2 and each preceding day - 3, 4, 5, etc. On Day 1 an open lower than Day 2's mid-range and lower than Day 2's close is necessary. Day 2 must be inside of Day 3. Day 3 must have a higher low than Day 4. A sale is made on the open of Day 1 with exit on the close of Day 1. Profits were eighty percent with winning trades five times the size of losing trades. The only shortcoming is that only ten trades could be found from 1982-1987.

- Pattern (4) is similar to Pattern (3) with opposite parameters. The only exception is the open on Day 1 need only to be higher, not above mid-range. So to review Pattern (4), Day 1 a higher open than Day 2. Day 2 inside Day 3. Day 3 lower high than Day 4. Results were as follows: Ninety-one percent profits; 860 to 820 average winner to average loser. No stops were used. Only eleven patterns to the upside were found.

The market action implied in each pattern is a short-term trend with a loss of momentum on the Inside Day. The open on Day 1 is in the opposite direction of the trend and is an indication of a shift in sentiment. This shift in sentiment causes those who still have existing positions against the opening direction to liquidate longs or cover shorts. Participants covering their positions is more than enough to tip off a directional move.

A slightly different perspective on the same type of pattern is to look for a retracement to the previous day's close after the opening and take a position at that point in the direction of the open. I tested four patterns to demonstrate this principle.

- Pattern (5) shows an Inside Day with a lower close on Day 2 than Day 3. Day 1's open is above Day 2's close. The chances are sixty-two percent that the market will close above Day 2's close on Day 1.

- Pattern (6) is an Inside Day on Day 2 with a higher close than Day 3. Day 1's open is above Day 2's close. The chances are seventy-nine percent that the market will close above Day 2's close on Day 1.

- Pattern (7) shows an Inside Day on Day 2 with a lower close than Day 3's close. Day 1's open is below Day 2's close. The chances are fifty-nine percent that the close on Day 1 will be lower than Day 2's close.

- Pattern (8) shows an Inside Day on Day 2 with a higher close than Day 3's close. Day 1's open is below Day 2's close. There is a sixty-seven percent chance that the market will close below Day 2's close on Day 1.

How can you use this information? It suggests a strong bias in the direction of the open especially after a higher open. The prolonged bull market obviously had an impact on these results but in general, a counter move back to Day 2's close after the opening direction is known, should be observed for a loss of momentum and possible entry in the direction of the open.

Another totally different test in the S+P has same interesting implications and could be tied in with the previous patterns. On any day that the market has moved two hundred points above the open intra-day, it has closed above the open ninety percent, of the time. Also, on any day that the market has moved two hundred points below the open it has closed below the open eighty-eight percent of the time. This was during the period from 1982-1988.

An application of these results is as follows: Enter in the direction of the initial trend on any low momentum move back to the open and exit on the close of the session. This can be done after the initial trend is established with a two hundred point move in one direction off the open. The main qualification is price action on the pullback. A high momentum move back through the open leaves the initial two hundred point move in question. This can also be applied after an Inside Day very effectively.

I think it is necessary to shed light on how extraordinary the results for Inside Days are: A test on a sale of a higher open or buy of a lower open with no other information to work with provides a winning trade fifty-six percent of the time when exiting on the close the same day of entry. This suggests a natural tendency for the market to reverse the opening direction by the time of the close.

This natural tendency is reversed after an ID. Why? What is it about an ID that produces follow through after the open? An ID is narrower than the previous day. Any narrowing day shows loss of momentum and when within a previous day's range it forms a congestion area. A congestion is directionless trade with the market searching for new information. A temporary state of balance or equilibrium exists.

There is a tendency for the market to trend after a congestion. If an Inside Day is a valid congestion, it will produce an imminent trend day. One can assume from the above tests that there is a tendency to trend after these patterns (ID). These tests support the premise that Inside Days are valid congestion areas. It appears that market participants act on the first piece of information indicating trend after the Inside Day - the open. Also, the direction of the close on the ID will provide further clues on the direction of the breakout when added to the information of opening direction. The increase in percentage profit and relative profits when these variables are added supports this conclusion.

Why do these indications work so well in the S+P? The S+P generally is an urgent market. The distinguishing characteristic of this market is its tendency to trend throughout the session. This market is notorious for big, fast moves intra-day. Peter Steidlmayer (Markets and Market Logic) calls it a One-Time Frame market. One may reason that in a One-Time Frame market the inside day is a more reliable indication of upcoming trend than in a Two-Time Frame market. The market principle that is in force is contraction/expansion. The Inside Day is contraction, and in a One-Time Frame market 1-Day contraction is all that is necessary to tip off a directional move.

In summary, the above tests suggest that an Inside Day is a valid congestion area and it follows that all breakout rules for congestion areas should be implemented after an Inside Day forms. The resulting breakout is expansion.

|

| Three-Bar Inside Bar Pattern by Johnan Prathap - HERE & HERE |

[...] The Principle of Contraction / Expansion is defined as the market phenomenon of change from a period of rest to a period of movement back to a period of rest. This interaction between the phases of motion and rest are constantly taking place, with one phase directly responsible for the others' existence. A Trend Day is defined as a day when the first hour's trade comprises less than 10% of the day's range or the market has no dominant area of trade throughout the session. Trend days are characterized by an opening near one extreme and a close on the opposite extreme of the daily range. Trend days fall into the category of expansions. Congestion is a series of trading days with no visible progress in either direction. Usually associated with narrow range days or non-trend days. Contraction is a market behavior represented by a congestion or dormant period either short-term (ID) or long-term narrow range (8 Bar NR) and usually reaching its narrowest phase at the end of the period.

Monday, July 4, 2022

In Any Bar Chart Only 8 Possible Range Patterns | Larry Williams

Larry Williams presented a free session at the November 2014 Las Vegas Traders Expo in which he discussed 8 possible Range Patterns. He showed that from any bar to the next there are only 4 possible outcomes:

- Down Range: Last Bar's high is lower than prior Bar's high; and last Bar's low is lower than prior Bar's low.

- Up Range: Last Bar's high is higher than prior Bar's high; and last Bar's low is higher than prior Bar's low.

- Inside Range: Last Bar's high is lower than prior Bar's high; and last Bar's low is higher than prior Bar's low. On a Daily S&P500 Chart this occurs approximately 12% of the time.

- Outside Range: Last Bar's high is higher than the prior Bar's high; and Bar's low is lower than the prior Bar's low. On a Daily S&P500 Chart this occurs approximately 12% of the time.

Price action cannot occur in any other way. Within these 4 Range Patterns each last bar can either be an up bar or a down bar. So there are actually 8 possible Range Patterns:

1. Down Range, Down Day

2. Down Range, Up Day

3. Up Range, Down Day

4. Up Range, Up Day

5. Inside Range, Down Day

6. Inside Range, Up Day

7. Outside Range, Down Day

8. Outside Range, Up Day

Using these 8 patterns some powerful strategies can be created. Larry Williams presented back-tested statistics associated with trading these patterns using a simple entry and exit technique. He stressed that they were not the best entry or exit techniques but shown because they were easy to understand and program. This strategy is intended only to show where we have a bias or advantage in the marketplace.

- Entry: At market close

- Stop Loss: Based on $ Stop

- Exit: First Profitable Opening

His message was that we could go home and verify using our own software. His results for testing this on the e-mini S&Ps from 2002 forward [to 2015] were as follows:

So, the Down Range, Down Close day [1.] offers the best potential short term 'long' setup based on net profit. This was the take-home message of the presentation.

Larry further dug into the Down Range, Down Close setup to uncover which day of the week offered the best trade: The stats support the 'Turnaround Tuesday' concept.

And further investigating by Trading Day of Month revealed that 1, 17, 19, 22 and 23 were the best days, showing 92% winners and $47,500 net profits with 107 trades.

It was also found that a Down Range Larger Range day was better than a Down Range smaller Range day. $205 Avg 80% Win, vs $33 Avg 85% win,

Also naked close was better than a covered close (naked close meaning that the close was outside of the previous day’s range). $155 Avg 83% Win vs $30 Avg 83% Win

And combining these two concepts:

Down Range, larger range, Covered close: $60 Avg, 83% Winners

Down Range, larger range, Naked close: $215 Avg, 85% Winners

References:

%20@%20X.jpg)

.jpg)