Research embracing many fields of scientific pursuit and all available historical records proves that the climate of the earth as a whole goes through long cycles. World-climate shifts from cold to warm periods and from wet to dry periods with amazing regularity. Dry periods accompanied by colder weather take place about every 170 years, every third such “cold drought” being severe in its effects.

|

"The turning points between old and new civilizations occur when cold-dry times reach their maximum severity." |

Professor Raymond H. Wheeler, eminent psychologist of the University of Kansas, heads this study project which finds an important correlation between world climate and political history. Dr. Wheeler's analysis of an immense accumulation of data shows that great international changes occur on these shifts from warm to cold and vice versa. Nations deteriorate on the shift from warm to cold, the study reveals. What is probably most fascinating among the findings is that totalitarianism is representative of world-wide political sentiment during warm periods. Democracy is vivified and sought after by men during cold periods. Intervals of cold droughts usually coincide with eras of civil wars. International wars are fought, for the most part, during warmer times. The Wheeler project has identified basic mass-psychological patterns with every climatic condition found in the global weather cycle. Public attitudes and popular ideas are directly colored by the general nature of the world-climate prevailing at any time.

|

| Raymond H. Wheeler and his 'big book'. |

Astrology offers a logical explanation for this 170-year rhythm in world activities. It is hardly a coincidence that every cold-drought is synchronized with one of the solar system's major planetary configurations. Called a great mutation in astrological parlance, a conjunction of the planets Uranus and Neptune occurs every 171 years, on the average. These conjunctions are within effective orb for 15 years before and after their central date of coming-together in the sky. This Uranus-Neptune cycle leaves a continuous impression on the unwinding scroll of world history in inciting those conditions in human and natural affairs described.

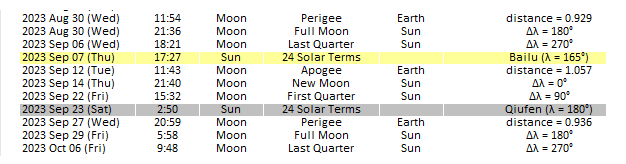

Central conjunctions of Uranus and Neptune took place in the A.D. years of

110, 281, 453, 624, 796, 967, 1139, 1310, 1481, 1653 and 1824 [1906-10, 1993, 2078-81, 2165]

[The years cited mark the general centers of the 30-year influence at work. They are computed for the conjunctions in mean heliocentric longitude, and not for the apparent (geocentric) times of occurrence. The time-margin allowed for this difference is nearly a whole decade.]

[The years cited mark the general centers of the 30-year influence at work. They are computed for the conjunctions in mean heliocentric longitude, and not for the apparent (geocentric) times of occurrence. The time-margin allowed for this difference is nearly a whole decade.]

Each of these epochs is at or near the dead center of a period of serious cold drought recorded in the annals of history and science. It is no surprise to the astrologer that lowered mean temperature, lack of much rainfall, political stress and civil war itself should be typical of our earth’s response to these vibrations. Uranian influences alone have long been recognized as revolutionary in action. Neptune is peculiarly associated with meteorological matters, and also with canons of idealistic thought. Astrologers are generally agreed that Neptune is the planet of “isms” and ideologies which provoke national and international changes of attitude. Uranus is disruptive in action and progressive in the long run. Neptune, on the other hand, is said to determine world sentiments which have an emotional base. Conjunctions of these divergent forces bring about the years of famine and civil strife which make and break the great economic and political structures we call nations.

The primary precipitation-and-temperature cycle is obviously connected with a particular interplanetary periodicity. There are dozens if not hundreds of other cycles in man’s social and natural environment which can be traced to similar causes. Relations of two or more planets to each other as viewed from the earth are called aspects. The positions of any moving heavenly body across the great star-sprangled backdrop of the sky are called transits. In astrology, we make use of the term transit to mean the location of a planet by the sign of the zodiac it occupies. Aspects and sign-transits of the various planets are the fundamental causes of cycles on earth. Although not actually zodiacal factors, the declinations of certain planets and changes in the elements of planetary orbits are found to be strong components in the astrological theory of world cycles.

Above and beyond true physical phenomena is the strange tendency of world affairs toward cycles which reflect the general connotations of successive zodiacal signs. This is apparent if one reconsiders the famous historical analyses of Oswald Spengler in the light of astrology. Spengler’s anthropomorphic outlines of spiritual, cultural and political “contemporary epochs” seem to follow a fascinating zodiac of characteristics, commencing each broad swing in mankind’s affairs with typical Aries qualities, and culminating it, after ten more eras, with Piscean attributes. The reason for this inclination is inexplicable, at the present, as no astronomical connection has been discovered.

Mention of such interesting matters lays the groundwork for our immediate subject — that of applying astrology as a calculable gauge of contemporary economic conditions.

Quoted from:

Donald A. Bradley (1950) – Stock Market Prediction. The Planetary Barometer and How to Use it.

See also:

Raymond H. Wheeler (1943) - The 100 Year Cycle - Climate, Regime Change and War.

Donald A. Bradley (1950) – Stock Market Prediction. The Planetary Barometer and How to Use it.

See also:

Raymond H. Wheeler (1943) - The 100 Year Cycle - Climate, Regime Change and War.

%20@%20X.jpg)

.jpg)