|

| Source: Torsten Sløk, Deutsche Bank Securities - found @ Barry Ritholtz |

Wednesday, August 26, 2015

China bigger Risk than Lehman, Greece, US Fiscal Problems?

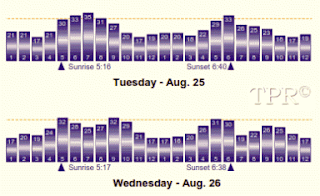

SPX vs Planetary Hours + SoLunar Intraday Map (Aug 25-26)

Monday, August 24, 2015

The Chart Whisperer Exlaining the Nature of this Crash

Shipping Indices Reflecting Real Economy

|

| Baltic Dry Index (HERE) |

The BDI is the main sea freight index at the Baltic Exchange for ships carrying dry bulk commodities. The BDI peaked out at 1,222 in early August and continued to drop to 994 points last Friday, mainly due to weak panamax rates. The overall index factors in average daily earnings of capesize, panamax, supramax and handysize dry bulk transport vessels.

|

| Shanghai Containerized Freight Index (HERE) |

U.S. Energy Consumption since 1776

|

| Credits: EIA |

Saturday, August 22, 2015

SPX vs AstroMetric Indicator

Eurodollar COT Signals Big Drop in Stocks Still Ahead | Tom McClellan

DJIA 2015 vs DJIA 2008

|

| Calculated and charted with Timing Solution. For the methodology see HERE |

Thursday, August 20, 2015

Planetary Hours + Times of Rising, Culminating and Setting Planets

|

| Times to watch Thursday, August 20, 2015 (EDT). Online calculators can be found HERE + HERE + HERE + HERE |

Wednesday, August 19, 2015

SoLunar Intraday Maps - August 2015

|

| The charts show the hourly solunar forces over Wall Street. Intraday movements of financial markets are strongly influenced by daily and intraday solunar forces. They usually closely follow their direction - either directly or inverted. Turning points can be fine-tuned using the previously described planetary hours as well as the times of rising, culminating and setting planets. Please note: The times calculated refer to EST (not EDT). |

|

| HERE |

Saturday, August 15, 2015

The Demographic Crash of Civilizations

The so-called "developed world" is neglecting one of the most fundamental responsibilities of any enduring civilization: raising the next generation. Civilization, culture, social cohesion, and economic prosperity all depend on a basic prerequisite—continued human existence. Without reproduction, all other achievements ultimately become irrelevant.

Approximately 8 million working-age adults (18 to 65) are unable to sustain themselves—either unemployed or trapped in precarious, low-wage employment such as contract work, “One-Euro jobs,” part-time roles, mini-jobs, and other exploitative schemes tied to the Hartz labor market reforms. Around half a million Germans are homeless, many of them children, in a system where the remaining taxpayers finance what can only be described as institutionalized social neglect.

The average worker surrenders nearly two-thirds of their gross income to taxation, while the state has poured €400 billion into rescuing failing banks and continues to pay €100 million in daily interest on public debt. Within this socio-economic landscape, roughly 650,000 children are born each year—one-third to parents of immigrant backgrounds—compared to around 840,000 deaths annually, resulting in a net loss of nearly 200,000 people per year.

In essence, as it rapidly ages and grows poorer, Germany loses the equivalent of a mid-sized city every year. Official projections indicate the population will shrink to between 65 and 74 million by 2060, depending on annual net migration levels (ranging from 100,000 to 400,000). Meanwhile, demographic collapse among the native population continues, marked by a third of women remaining childless, over 200,000 abortions annually, and other structural factors contributing to a sustained decline in birth rates.

Combined with immigration policies perceived by critics as prioritizing replacement over integration, Germany faces the potential erasure of its historic national identity within this century. This trajectory is not unique; similar patterns can be observed across nearly all other European nations.

As of today, the global average fertility rate stands at 2.3, with 80% of the world’s population living in countries where women, on average, have fewer than three children. This means that global fertility is only marginally above the replacement level, and current population growth is primarily driven by increased life expectancy rather than high birth rates. In 1960, China’s fertility rate was 6.1; today it has fallen to 1.6. Iran’s fertility rate dropped from 6.3 in 1985 to 1.9 today. Thailand followed a similar trajectory: from 6.14 in 1955 to 3.92 in 1985, and down to 1.49 today.

The issue facing the developed world is not only economic stagnation but also demographic decline. Many nations are aging rapidly and experiencing fertility rates well below the replacement threshold—some have arguably passed the demographic point of no return. The lowest fertility rates globally are concentrated in the most industrialized regions of Asia: China (1.55), Japan (1.40), South Korea (1.25), Taiwan (1.11), Hong Kong (1.04), Macau (0.91), and Singapore (0.80). Similarly low, near-extinction fertility rates are seen in parts of Southern Europe and former Soviet states: Portugal (1.52), Spain (1.48), Italy (1.42), Greece (1.41), Poland (1.33), and Ukraine (1.30).

In contrast, Africa remains demographically youthful. In 2015, children under 15 made up 41% of its population, with another 19% aged 15 to 24. Latin America and the Caribbean, as well as much of Asia—regions that have seen substantial fertility declines—show smaller proportions of children (26% and 24%, respectively) and comparable shares of youth (17% and 16%). Together, these three regions were home to 1.7 billion children and 1.1 billion young people in 2015.

|

| Source: UN DESA |

Monday, August 10, 2015

Bull and Bear Markets in Oil 1861-2015

|

| Credit Suisse notes that bear markets in oil prices last between 11 and 28 years, while bull markets typically last less than 10. |

Friday, August 7, 2015

The Real Price of Gold

|

| A “golden constant” perspective suggests a fair value price for gold of $825 an ounce (HERE) |

Campbell R. Harvey (Aug 3, 2015) - Using the U.S. Consumer Price Index as an arbitrary, though conventional, fundamental driver of the price of gold, the high real price of gold has been about 8.73, the low real price of gold has been about 1.47 and the current real price of gold is about 4.63.

[...] There are at least two ways to think about the current historically high real price of gold. One is that the real price of gold may “mean revert” towards the horizontal rust colored line, the golden constant value for gold linked with the average real price of gold. Or it is also possible that all of “history is more or less bunk”, as Henry Ford once put it, reflecting an idea that bold investors and innovators were never slaves to history.

Tuesday, August 4, 2015

The Strangeloves, the Crazies and the Butchers

|

| War Cycles on the rise (HERE) |

Sunday, August 2, 2015

Marvels of Creation - The Sun and the Lunar Cycle

|

| Credits: Nick Anthony Fiorenza |

Saturday, August 1, 2015

DJIA vs Lunar North Node in Zodiac Signs | Louise McWhirter

In her book 'Astrology and Stock Market Forecasting' published almost 80 years ago, financial astrologer Louise McWhirter described a theory of the business cycle. She claimed the low point of the depression was reached in summer of 1933 (Lunar North Node in Aquarius) and predicted the next peak in economic activity would occur in November 1942 (NN in Leo). Her prediction for recovery in 1942 coincided with the massive economic stimulus spending set in motion by the build-up for World War II. Looking at 100 years of stock market prices she consistently found the North Node in the sign of Aquarius during periods of low economic activity. At the halfway point in the 18.6-year cycle, the North Node is moving into the sign of Leo, where economic high points have historically been recorded. After this, the long-term trend moves lower as the North Node slowly and systematically makes its way back to the sign of Aquarius, where the cycle begins anew (see also HERE).

|

| Enlarge |

Ranking of Countries by Sovereign Debt in Percent of GDP and Absolute Debt

405 Year Sunspot Record Revised and Newly Calibrated

|

| Credits: SILSO Data - Royal Observatory of Belgium, Brussels |

Yet, this important change to one of science’s most fundamental measurements went literally unnoticed (HERE & HERE) Two sunspot record time series were recalibrated: The first is the traditional International Sunspot Number (ISN) record most people are familiar with. The second is the more physically meaningful group number. Groups have always been counted as part of the ISN. The newly released group number update redefines and corrects defects in the original 1998 version. The newly rebuilt group number time series shows that solar activity is considerably more ‘even’ over its 405-year history than previously thought. Formerly, it looked as though sunspot activity in the past was much weaker than at present, especially prior to 1890. Counting inconsistencies artificially created that non-existent effect. The rebuilt record contains four distinctive dips in solar activity that occur roughly every 100 years.

Friday, July 31, 2015

“Cosmic Causation in Geophysics” - W.D. Gann's Reading List

|

| HERE |

Unlike the title suggests, “Cosmic Causation in Geophysics” has nothing to do with geophysics nor with trading, and is certainly but another incoherent, eclectic and non-relevant trivia in W.D. Gann's long Reading List. Why Mr. Gann advised his students to waste time on such humbug? Didn't he know better?

SPX vs 20th Harmonic of Earth-Venus Cycle

Thursday, July 30, 2015

The Art of Measuring Time

|

| Prague Astronomical Clock (HERE) |

Most of the first clocks were not so much chronometers as exhibitions of the pattern of the cosmos. Clearly the origins of the mechanical clock lie in a complex realm of monumental planetariums.

The medieval Prague Astronomical Clock at left was installed in 1410 - more than 130 years before Copernicus published ‘On the Revolutions of the Celestial Spheres’ in 1543. It is the third-oldest astronomical clock in the world and the oldest one still working (HERE)

Wednesday, July 29, 2015

The Fractal Design of Time | Martin A. Armstrong

- The model consists of cycle waves that vary in length, from shorter to longer, and build up over time; for example, 8.6 to 51.6 to 309.6 years.

- It examines these cycle waves to discover when they are set to culminate, reflecting a possible shift in market confidence at that point in time.

- This shift in confidence is reflected by capital flows and concentration.

- The longer the cycle wave, the greater the magnitude of the shift in confidence.

- The dates in the model that reflect possible shifts are referred to as ECM turning points.