Many of the commodities seem to have had a consistently decreasing real price prior to the last 100 years. Commodities that look particularly cheap are generally agricultural ones while the more industrial based commodities seem to be at the more expensive end of history, in part fueled by significant demand from China over the past decade. This is particularly true when looking at data over the past 100 years. Precious metals also look expensive from a historical stand-point, which probably reflects the post-1971 fiat currency regime we currently operate in. One of the problems with this analysis is that the importance of these commodities changes over time as does the cost of mining them. Source: Deutsche Bank (2015) - Long-Term Asset Return Study.

Wednesday, September 9, 2015

Most Commodities Historically Cheap

Many of the commodities seem to have had a consistently decreasing real price prior to the last 100 years. Commodities that look particularly cheap are generally agricultural ones while the more industrial based commodities seem to be at the more expensive end of history, in part fueled by significant demand from China over the past decade. This is particularly true when looking at data over the past 100 years. Precious metals also look expensive from a historical stand-point, which probably reflects the post-1971 fiat currency regime we currently operate in. One of the problems with this analysis is that the importance of these commodities changes over time as does the cost of mining them. Source: Deutsche Bank (2015) - Long-Term Asset Return Study.

The Rise and Fall of Modern Empires

In 1950 China’s share of the world’s population was 29%, its share of world economic output (on a PPP basis) was about 5%. By contrast the US was almost the reverse, with 8% of the world’s population the US commanded 28% of its economic output. By 2008, China’s huge, centuries-long economic underperformance was well down the path of being overcome. Based on current trends China’s economy will overtake America’s in purchasing power terms within the next few years. The US is now no longer the world’s sole economic superpower and indeed its share of world output (on a PPP basis) has slipped below the 20% level which we have seen was a useful sign historically of a single dominant economic superpower. In economic terms we already live in a bipolar world. Between them the US and China today control over a third of world output (on a PPP basis). Source: Deutsche Bank (2015) - Long-Term Asset Return Study.

Labels:

China,

Deutsche Bank,

Empire,

Geopolitics,

OT,

USA

Tuesday, September 8, 2015

SPX vs MER-MAR Speed Differential

Labels:

AstroFin,

Financial Astrology,

George Bayer,

George Bayer Rule #2,

Mars,

Mercury,

Speed,

SPX,

US-Stocks

Peak Everything: Bonds - Equity - Real Estate

|

| Credits: Deutsche Bank |

Labels:

Bonds,

Deutsche Bank,

Equity,

Real Estate,

Stock Market

SPX vs MER-VEN Cycle

Labels:

AstroFin,

Financial Astrology,

geocentric,

heliocentric,

Mercury,

SPX,

US-Stocks,

Venus

Thursday, September 3, 2015

The Lowest Interest Rates in 5,000 Years

|

| Sources: Bank of England, Global Financial Data, Homer and Sylla "A History of Interest Rates". |

Tuesday, September 1, 2015

Blood Moon Ends Lunar Tetrad - SuperMoon Lunar Eclipse on September 28

|

| Credits: NASA |

There's much talk about the Seven Year Shemitah Cycle and related stock market crashes. However, eclipses occur near the Lunar Nodes: Solar eclipses (September 13) when the passage of the Moon through a Node coincides with the New Moon, and Lunar Eclipses (September 28) when the passage coincides with the Full Moon (HERE + HERE).

Labels:

Astronomy,

Blood Moon,

Fred Espenak,

Harvest Moon,

Lunar Cycle,

Lunar Eclipse,

Lunar Node,

Lunar Node's Speed,

Lunar Tetrad,

NASA,

Richard Nolle,

Seven Year Shemitah Cycle,

Solar Eclipse,

SuperMoon

SoLunar Intraday Maps - September 2015

|

| The charts show the hourly solunar forces over Wall Street. Intraday movements of financial markets are strongly influenced by daily and intraday solunar forces. They usually closely follow their direction - either directly or inverted. Turning points can be fine-tuned using the previously described planetary hours as well as the times of rising, culminating and setting planets. Please note: Times are EST (not EDT). Maps of previous months are HERE |

Labels:

AstroFin,

Astronomy,

Bonds,

Commodities,

Financial Astrology,

Planetary Hours,

SoLunar Forecast,

SoLunar Intraday Maps,

SoLunar Map,

Solunar Theory,

US-Stocks

Saturday, August 29, 2015

Financial Fascism - The Elimination of Physical Currency

|

| “Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power.” ― Benito Mussolini, 1932 |

“The existence of cash — a bearer instrument with a zero interest rate — limits central banks’ ability to stimulate a depressed economy. The worry is that people will change their deposits for cash if a central bank moves rates into negative territory,” states the article. Complaining that cash cannot be tracked and traced, the writer argues that its abolition would, “make life easier for a government set on squeezing the informal economy out of existence.” Abolishing cash would also give governments more power to lift taxes directly from people’s bank accounts, the author argues, noting how “Value added tax, for example, could be automatically levied — and reimbursed — in real time on transactions between liable bank accounts.”

|

| Totalitarianism of the European Financial Oligarchy - Votes change nothing! |

Labels:

Benito Mussolini,

Bilderberg Group,

Corporatism,

ECB,

Elimination of Physical Currency,

Fascism,

FED,

Financial Oligarchy,

Kenneth Rogoff,

Martin A. Armstrong,

Paul Joseph Watson,

Thomas Jefferson

Friday, August 28, 2015

VIX vs 4 Lunar Year Cycle

Labels:

4 Lunar Year Cycle,

AstroFin,

Financial Astrology,

Lunar Eclipse,

Moon,

Solar Eclipse,

US-Stocks,

VIX

Upcoming Astro Phenomena - September 2015

Sep 05 (Sat) = SUN 120° PLU

Sep 06 (Sun) = VEN (D)

Sep 13 (Sun) = New Moon = Solar Eclipse

Sep 17 (Thu) = JUP 180° NEP

Sep 19 (Sat) = VEN 0° URA [helio]

Sep 20 (Sun) = SUN 90° Galactic Center

Sep 22 (Tue) = VEN 120° URA

Sep 24 (Thu) = PLU (D)

Sep 25 (Fri) = MAR 90° SAT

Sep 28 (Mon) = Super Full Moon + Lunar Eclipse

SoLunar CITs (HERE)

Sep 02 (Wed), Sep 06 (Sun), Sep 10 (Thu), Sep 13 (Sun), Sep 17 (Thu), Sep 21 (Mon), Sep 24 (Thu), Sep 28 (Mon)

Cosmic Cluster Days (HERE)

Sep 01 (Tue), Sep 03 (Thu), Sep 07 (Mon), Sep 08 (Tue), Sep 15 (Tue), Sep 19 (Sat), Sep 30 (Wed)

Bradley Siderograph CITs (HERE)

Sep 03 (Thu), Sep 05 (Sat), Sep 24 (Thu), Sep 29 (Tue)

Planets vs Galactic Center (HERE)

Sep 20 (Sun) = SUN 90° GC

SUN and Planets @ 14°Cancer (HERE)

Sep 20 (Sun)

Natural Trading Days (HERE)

Fall Equinox = Sep 23 (Wed)

Radio Flux 10.7 cm Forecast CITs (HERE)

Sep 1 (Tue), Sep 4 (Fri), Sep 11 (Fri), Sep 20 (Sun), Sep 30 (Wed)

Sensitive Degrees of the SUN (HERE)

Sep 02 (Wed) 15:04 = SUN @ 10° VIR -

Sep 04 (Fri) 16:38 = SUN @ 12° VIR +

Sep 05 (Sat) 17:23 = SUN @ 13° VIR -

Sep 21 (Mon) 03:08 = SUN @ 28° VIR +

Sep 25 (Fri) 05:15 = SUN @ 02° LIB -

|

| 10.7 cm Flux is considered a sunspot-proxy. Source: NOAA |

Labels:

10.7 cm Radio Flux,

AstroFin,

Astronomy,

Bradley Index,

Bradley Siderograph,

Cosmic Cluster Days,

Declination,

Latitude,

Market and Solar Activity,

Planets @ 14°Cancer,

SoLunar Map

Thursday, August 27, 2015

SPX vs Sunspots

Labels:

10.7cm Flux,

AP,

AstroFin,

Financial Astrology,

Market and Solar Activity,

NOAA,

SPX,

Sunspots,

US-Stocks

Wednesday, August 26, 2015

SPX vs SUN-JUP Cycle

|

| The SoLunar Map signals a turn down today. Well, the Shanghai Stock Exchange Composite Index (SSEC) did tank again. |

|

| Calculated and charted with Timing Solution. |

Labels:

AstroFin,

Financial Astrology,

Jupiter,

SPX,

Sun,

Timing Solution,

US-Stocks

Expected Future S&P 500 Earnings

|

| Source: Political Calculations |

Labels:

Political Calculations,

Quarter Earnings,

SPX,

US-Stocks

China bigger Risk than Lehman, Greece, US Fiscal Problems?

|

| Source: Torsten Sløk, Deutsche Bank Securities - found @ Barry Ritholtz |

Labels:

Barry Ritholtz,

China,

Debt Crisis,

Deutsche Bank,

Greece,

Torsten Sløk,

VIX,

VVIX

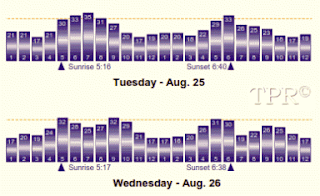

SPX vs Planetary Hours + SoLunar Intraday Map (Aug 25-26)

Labels:

AstroFin,

Financial Astrology,

Intraday,

Planetary Hours,

SoLunar Intraday Maps,

SoLunar Map,

SPX

Monday, August 24, 2015

The Chart Whisperer Exlaining the Nature of this Crash

Labels:

4 Lunar Year Cycle,

Astrometric Indicator,

Dodd–Frank Wall Street Reform and Consumer Protection Act,

FED,

Financial Astrology,

Liquiity,

Lunar Node's Speed,

Oscar Carboni,

QE,

W.D. Gann's Financial Table

Shipping Indices Reflecting Real Economy

|

| Baltic Dry Index (HERE) |

The BDI is the main sea freight index at the Baltic Exchange for ships carrying dry bulk commodities. The BDI peaked out at 1,222 in early August and continued to drop to 994 points last Friday, mainly due to weak panamax rates. The overall index factors in average daily earnings of capesize, panamax, supramax and handysize dry bulk transport vessels.

|

| Shanghai Containerized Freight Index (HERE) |

U.S. Energy Consumption since 1776

|

| Credits: EIA |

Labels:

Coal,

Crude Oil,

Energy,

Historical Charts,

Hydro Power,

Natural Gas,

Nuclear Power,

Renewables,

USA

Saturday, August 22, 2015

Subscribe to:

Posts (Atom)