|

| See also HERE |

Saturday, September 26, 2015

Interest Rates 1150 - 2014 (Historical Charts)

Ranking Sovereign Debt - Three Ways To Look At Keynesian Insanity

Jeff Hirsch: October’s Typical Performance

Jeff Hirsch (Sep 26, 2015) - October’s typical performance appears in the chart at left over the recent 21-year span 1994 to 2014. On average, early month weakness has proven to be an excellent buying opportunity, especially for NASDAQ (purple line) as early losses were quickly recouped leading to an average gain of over 3% from early month lows to the close.

Since 1991, October, the first month of the fourth quarter has improved substantially, climbing to fourth best DJIA month with an average gain of 1.6%. It’s the third best S&P 500 month (+1.6%) and second best for NASDAQ (+2.3%). Russell 2000 has not seen as much improvement with October climbing to just #8.

Since 1991, October, the first month of the fourth quarter has improved substantially, climbing to fourth best DJIA month with an average gain of 1.6%. It’s the third best S&P 500 month (+1.6%) and second best for NASDAQ (+2.3%). Russell 2000 has not seen as much improvement with October climbing to just #8.

Labels:

Jeffrey A. Hirsch,

Seasonality,

US-Stocks

Highest Daily Sunspot Number since April 2014

Labels:

AstroFin,

Financial Astrology,

Market and Solar Activity,

NOAA,

SPX,

Sunspots,

US-Stocks

Friday, September 25, 2015

Bund Spread Gives Permission for Bear Market | Tom McClellan

Tom McClellan (Sep 24, 2015) - [...]

German government bonds are known in the industry as “Bunds”, a

contraction of the prefix “bundes” which is German for “federal”. At

the major stock market tops in 2000 and 2007, we saw the peak in the

10-year Bund-Treasury spread appear well in advance of the final price

tops for stocks. So because that spread was still rising in April 2014,

my supposition then was that the uptrend had more months to live. Now we see a different condition.

The Bund-Treasury spread peaked at

1.81 percentage points back in March 2015, and has since been

contracting. Meanwhile, the DJIA and SP500 kept on rising to

incrementally higher price highs as the summer wore on, eventually

breaking down with the August 2015 minicrash.

[...] With a divergence now in place between the DJIA and the Bund-Treasury spread, we can have a reasonable expectation that a bear market for stock prices should ensue. If it plays out like the last two, the bear market should last until the Bund-Treasury spread gets back down at least to parity, or preferably even lower. That could take a while; in the 2000 and 2007 examples, it took a couple of years. The eurodollar COT leading indication already tells us to expect a downward trend until April 2016, so that gives us at least several months to see how the Bund-Treasury spread behaves.

|

| Credits: Tom McClellan HERE + HERE |

[...] With a divergence now in place between the DJIA and the Bund-Treasury spread, we can have a reasonable expectation that a bear market for stock prices should ensue. If it plays out like the last two, the bear market should last until the Bund-Treasury spread gets back down at least to parity, or preferably even lower. That could take a while; in the 2000 and 2007 examples, it took a couple of years. The eurodollar COT leading indication already tells us to expect a downward trend until April 2016, so that gives us at least several months to see how the Bund-Treasury spread behaves.

Labels:

10-year Bund-Treasury,

Bonds,

DJIA,

Eurodollar COT’s Leading Indication,

Tom McClellan,

US-Stocks

Thursday, September 24, 2015

SPX 2015 vs SPX 1987

Labels:

Sergey Tarassov,

Similarity Cycle,

SPX,

Timing Solution,

US-Stocks

SPX 2015 vs SPX 2011

Labels:

Sergey Tarassov,

Similarity Cycle,

SPX,

Timing Solution,

US-Stocks

Wednesday, September 23, 2015

SPX vs Sunspots

|

| Sunspots shifted +49 days |

|

| The Ap index measures geomagnetic activity and the 10.7 cm Flux is considered a sunspot-proxy. Source: NOAA |

Labels:

10.7cm Flux,

AP,

AstroFin,

Financial Astrology,

Market and Solar Activity,

NOAA,

SPX,

Sunspots,

US-Stocks

Martin Armstrong on the DJIA

Martin Armstrong (Sep 23, 2015) - [...] Yes, if this week simply closes on the Dow below 16280, then we can be looking at that slingshot move I have warned about where in one year, we have a crash and a swing to the upside to new highs (see also HERE + HERE).

[...] Remember, if the stocks decline into 2015.75, that should push more and more capital into government bonds completing the BUBBLE. This is by no means a BUBBLE in stocks, commodities, or the dollar. This is a peak in GOVERNMENT. This is not even a Kondratieff Wave based upon commodities. This is the 309.6 year cycle in government and unfortunately, the other side of 2015.75 is not looking very pretty. This not about just the collapse of Europe. This is the collapse of Western forms of government that aids the shift in the financial capital of world to China by 2032 (how to read the above Forecast Array = HERE + HERE).

Labels:

18.6 Year Cycle,

2015.75,

309.6 Year Cycle,

Bonds,

DJIA,

Martin A. Armstrong,

Peak Government,

US Dollar,

US-Stocks

Tuesday, September 22, 2015

SPX vs Lunar Node's Speed

|

| Market CITs are likely when the Lunar Node's Speed (degrees longitude/day) is at MIN/MAX and at 0. The Eclipse Crash Window opens and closes around 21 days before and 21 days after the Solar- and Lunar Eclipses. The table at left shows the nodal speed at MIN/MAX and at 0 during the next 30 days. The Sun will conjunct the Lunar Node (North Node) on Sep 24 (Thu). See also HERE + HERE |

Labels:

18 Year Cycle,

18.61,

AstroFin,

Astronomy,

Lunar Eclipse,

Lunar Node's Speed,

Mean Lunar Node,

Moon Wobble,

Nodal Cycle,

Nodal Speed,

North Node,

Solar Eclipse,

SPX,

Sun,

True Lunar Node,

US-Stocks

Volkswagen "totally screwed up" - Value Down EUR 20 Billion (so far)

|

| HERE |

Sunday, September 20, 2015

If your work is affected by geomagnetic disturbances ...

Labels:

AstroFin,

Astronomy,

Equinox,

Financial Astrology,

Geomagnetic Forecast,

Geomagnetism,

Inversion,

Inversion of Polarity,

K Index,

KP Index,

Leif Svalgaard,

Market and Solar Activity,

Seasonality

Saturday, September 19, 2015

By That Pure, Holy, Four Lettered Name On High | Pythagoras

|

| The Pythagorean Oath mentions the Tetractys: "By that pure, holy, four lettered name on high, nature's eternal fountain and supply, the parent of all souls that living be, by him, with faith find oath, I swear to thee." Credits: Michæl Paukner |

Albert Mackey (1873) - "The Greek word 'Tetractys' signifies, literally, the number four, and is synonymous with the quaternion; but it has been peculiarly applied to a symbol of the Pythagoreans, which is composed of ten dots arranged in a triangular form of four rows."

The first four numbers symbolize the harmony of the spheres and the Cosmos as: (1) Unity (Monad); (2) Dyad - Power - Limit/Unlimited; (3) Harmony (Triad); (4) Kosmos (Tetrad) - The four rows add up to ten, which was unity of a higher order (The Dekad). The Tetractys symbolizes the four elements — fire, air, water, and earth. The Tetractys represented the organization of space: the first row represented zero dimensions (a point). The second row represented one dimension (a line of two points). The third row represented two dimensions (a plane defined by a triangle of three points). The fourth row represented three dimensions (a tetrahedron defined by four points).

The Pythagorean musical system is based on the Tetractys as the rows can be read as the ratios of 4:3 (perfect fourth), 3:2 (perfect fifth), 2:1 (octave), forming the basic intervals of the Pythagorean scales. That is, Pythagorean scales are generated from combining pure fourths (in a 4:3 relation), pure fifths (in a 3:2 relation), and the simple ratios of the unison 1:1 and the octave 2:1. The diapason, 2:1 (octave), and the diapason plus diapente, 3:1 (compound fifth or perfect twelfth), are consonant intervals according to the tetractys of the decad. The diapason plus diatessaron, 8:3 (compound fourth or perfect eleventh), is not.

Labels:

Albert Mackey,

Masonry,

Michæl Paukner,

Musica universalis,

Numerology,

OT,

Pythagoras,

Pythagorean Oath,

Pythagorean Scale,

Quaternion,

Sacred Geometry,

Tetractys,

Tetrad

Squaring the Circle with the Earth and the Moon

|

| The perimeter of a square around the Earth equals the perimeter of a circle drawn through the center of the Moon. Credits: Michæl Paukner |

In 1882, the task was proven to be impossible, as a consequence of the Lindemann–Weierstrass theorem which proves that pi (π) is a transcendental, rather than an algebraic irrational number; that is, it is not the root of any polynomial with rational coefficients. It had been known for some decades before then that the construction would be impossible if pi were transcendental, but pi was not proven transcendental until 1882. Approximate squaring to any given non-perfect accuracy, in contrast, is possible in a finite number of steps, since there are rational numbers arbitrarily close to π.

Labels:

Earth,

Euclidean Geometry,

Lindemann–Weierstrass Theorem,

Michæl Paukner,

Moon,

OT,

Sacred Geometry,

Squaring the Circle

SPX vs Declination of MER + VEN

|

| Stock Markets change direction when the direction of the declinations of Mercury and Venus is changing (MIN + MAX), and when the declinations are parallel (crossings in the chart). |

Labels:

AstroFin,

Declination,

Financial Astrology,

Mercury,

SPX,

US-Stocks,

Venus

Wednesday, September 16, 2015

Sell in May - Buy in October

|

| Credits: Jeff Hirsch |

Agriculture’s share of GDP began to shrink post World War II as industrialization created a growing middle class that moved to the suburbs where hard-earned salaries would be spent filling new homes with all the modern conveniences we all take for granted now. Farming became more efficient and fewer and fewer people worked on the farm. Suddenly, summer was less about the hard work of harvesting crops and more about vacations and relaxing. As the economy evolved and peoples’ lives changed, the market evolved. June and August went from being top performing months to bottom performing months. August went from #1 to #10 in 1950-2014 with an average loss of 0.1%. June went from #4 to #11 (–0.3% average loss). The shift in DJIA’s seasonal pattern is clear in the [above] chart. “Sell in May” is a post WWII pattern, prior to then it would have been “Buy in May”.

Labels:

DJIA,

Jeffrey A. Hirsch,

Seasonality,

SPX,

US-Stocks

China's Raw Materials Consumption

Visual Capitalist (Sep 11, 2015) - Over the last 20 years, the world economy has relied on the Chinese economic growth engine more than it would like to admit. The 1.4 billion people living in the world’s most populous country account for 13% of global GDP, which is significant no matter how it is interpreted. However, in the commodity sector, China has another magnitude of importance. The fact is that China consumes mind-bending amounts of materials, energy, and food. That’s why the prospect of slowing Chinese growth is likely to continue as a source of nightmares for investors focused on the commodity sector.

China consumes a big proportion of the world’s materials used in infrastructure. It consumes 54% of aluminum, 48% of copper, 50% of nickel, 45% of all steel, and 60% of concrete. In fact, China has consumed more concrete in the last three years than the United States did in all of the 20th century. China is also prolific in accumulating precious metals – the country buys or mines 23% of gold and 15% of the world’s silver supply. With many mouths to feed, China also needs large amounts of food. About 30% of rice, 22% of corn, and 17% of wheat gets eaten by the Chinese. Lastly, the country is no hack in terms of burning fuel either. Notably, China uses 49% of coal for power generation as well as metallurgical processes in making steel. It also uses 13% of the world’s uranium and 12% of all oil.

China consumes a big proportion of the world’s materials used in infrastructure. It consumes 54% of aluminum, 48% of copper, 50% of nickel, 45% of all steel, and 60% of concrete. In fact, China has consumed more concrete in the last three years than the United States did in all of the 20th century. China is also prolific in accumulating precious metals – the country buys or mines 23% of gold and 15% of the world’s silver supply. With many mouths to feed, China also needs large amounts of food. About 30% of rice, 22% of corn, and 17% of wheat gets eaten by the Chinese. Lastly, the country is no hack in terms of burning fuel either. Notably, China uses 49% of coal for power generation as well as metallurgical processes in making steel. It also uses 13% of the world’s uranium and 12% of all oil.

Labels:

China,

Commodities,

www.visualcapitalist.com

Friday, September 11, 2015

China’s Middle Class Growing Explosively

While the Long Noses are converting good parts of the world - including most of their home countries - into

disaster zones and failed states, half a billion Chinese are ascending into the middle

class: In 2010 mainstream consumers—those with enough money to buy cars, fridges and phones but not Rolls-Royces—made up less than a tenth of urban Chinese households. McKinsey predicts that only by 2020 the income-middle class will grow by 1,000% to make up well over half of the Chinese population while the percentage of the very poor will be cut in half. Credits: McKinsey + The Economist

Labels:

China,

McKinsey,

Middle Class,

The Economist

Wednesday, September 9, 2015

Most Commodities Historically Cheap

Many of the commodities seem to have had a consistently decreasing real price prior to the last 100 years. Commodities that look particularly cheap are generally agricultural ones while the more industrial based commodities seem to be at the more expensive end of history, in part fueled by significant demand from China over the past decade. This is particularly true when looking at data over the past 100 years. Precious metals also look expensive from a historical stand-point, which probably reflects the post-1971 fiat currency regime we currently operate in. One of the problems with this analysis is that the importance of these commodities changes over time as does the cost of mining them. Source: Deutsche Bank (2015) - Long-Term Asset Return Study.

The Rise and Fall of Modern Empires

In 1950 China’s share of the world’s population was 29%, its share of world economic output (on a PPP basis) was about 5%. By contrast the US was almost the reverse, with 8% of the world’s population the US commanded 28% of its economic output. By 2008, China’s huge, centuries-long economic underperformance was well down the path of being overcome. Based on current trends China’s economy will overtake America’s in purchasing power terms within the next few years. The US is now no longer the world’s sole economic superpower and indeed its share of world output (on a PPP basis) has slipped below the 20% level which we have seen was a useful sign historically of a single dominant economic superpower. In economic terms we already live in a bipolar world. Between them the US and China today control over a third of world output (on a PPP basis). Source: Deutsche Bank (2015) - Long-Term Asset Return Study.

Labels:

China,

Deutsche Bank,

Empire,

Geopolitics,

OT,

USA

Tuesday, September 8, 2015

SPX vs MER-MAR Speed Differential

Labels:

AstroFin,

Financial Astrology,

George Bayer,

George Bayer Rule #2,

Mars,

Mercury,

Speed,

SPX,

US-Stocks

Peak Everything: Bonds - Equity - Real Estate

|

| Credits: Deutsche Bank |

Labels:

Bonds,

Deutsche Bank,

Equity,

Real Estate,

Stock Market

SPX vs MER-VEN Cycle

Labels:

AstroFin,

Financial Astrology,

geocentric,

heliocentric,

Mercury,

SPX,

US-Stocks,

Venus

Thursday, September 3, 2015

The Lowest Interest Rates in 5,000 Years

|

| Sources: Bank of England, Global Financial Data, Homer and Sylla "A History of Interest Rates". |

Tuesday, September 1, 2015

Blood Moon Ends Lunar Tetrad - SuperMoon Lunar Eclipse on September 28

|

| Credits: NASA |

There's much talk about the Seven Year Shemitah Cycle and related stock market crashes. However, eclipses occur near the Lunar Nodes: Solar eclipses (September 13) when the passage of the Moon through a Node coincides with the New Moon, and Lunar Eclipses (September 28) when the passage coincides with the Full Moon (HERE + HERE).

Labels:

Astronomy,

Blood Moon,

Fred Espenak,

Harvest Moon,

Lunar Cycle,

Lunar Eclipse,

Lunar Node,

Lunar Node's Speed,

Lunar Tetrad,

NASA,

Richard Nolle,

Seven Year Shemitah Cycle,

Solar Eclipse,

SuperMoon

SoLunar Intraday Maps - September 2015

|

| The charts show the hourly solunar forces over Wall Street. Intraday movements of financial markets are strongly influenced by daily and intraday solunar forces. They usually closely follow their direction - either directly or inverted. Turning points can be fine-tuned using the previously described planetary hours as well as the times of rising, culminating and setting planets. Please note: Times are EST (not EDT). Maps of previous months are HERE |

Labels:

AstroFin,

Astronomy,

Bonds,

Commodities,

Financial Astrology,

Planetary Hours,

SoLunar Forecast,

SoLunar Intraday Maps,

SoLunar Map,

Solunar Theory,

US-Stocks

Saturday, August 29, 2015

Financial Fascism - The Elimination of Physical Currency

|

| “Fascism should more appropriately be called Corporatism because it is a merger of state and corporate power.” ― Benito Mussolini, 1932 |

“The existence of cash — a bearer instrument with a zero interest rate — limits central banks’ ability to stimulate a depressed economy. The worry is that people will change their deposits for cash if a central bank moves rates into negative territory,” states the article. Complaining that cash cannot be tracked and traced, the writer argues that its abolition would, “make life easier for a government set on squeezing the informal economy out of existence.” Abolishing cash would also give governments more power to lift taxes directly from people’s bank accounts, the author argues, noting how “Value added tax, for example, could be automatically levied — and reimbursed — in real time on transactions between liable bank accounts.”

|

| Totalitarianism of the European Financial Oligarchy - Votes change nothing! |

Labels:

Benito Mussolini,

Bilderberg Group,

Corporatism,

ECB,

Elimination of Physical Currency,

Fascism,

FED,

Financial Oligarchy,

Kenneth Rogoff,

Martin A. Armstrong,

Paul Joseph Watson,

Thomas Jefferson

Friday, August 28, 2015

VIX vs 4 Lunar Year Cycle

Labels:

4 Lunar Year Cycle,

AstroFin,

Financial Astrology,

Lunar Eclipse,

Moon,

Solar Eclipse,

US-Stocks,

VIX

Upcoming Astro Phenomena - September 2015

Sep 05 (Sat) = SUN 120° PLU

Sep 06 (Sun) = VEN (D)

Sep 13 (Sun) = New Moon = Solar Eclipse

Sep 17 (Thu) = JUP 180° NEP

Sep 19 (Sat) = VEN 0° URA [helio]

Sep 20 (Sun) = SUN 90° Galactic Center

Sep 22 (Tue) = VEN 120° URA

Sep 24 (Thu) = PLU (D)

Sep 25 (Fri) = MAR 90° SAT

Sep 28 (Mon) = Super Full Moon + Lunar Eclipse

SoLunar CITs (HERE)

Sep 02 (Wed), Sep 06 (Sun), Sep 10 (Thu), Sep 13 (Sun), Sep 17 (Thu), Sep 21 (Mon), Sep 24 (Thu), Sep 28 (Mon)

Cosmic Cluster Days (HERE)

Sep 01 (Tue), Sep 03 (Thu), Sep 07 (Mon), Sep 08 (Tue), Sep 15 (Tue), Sep 19 (Sat), Sep 30 (Wed)

Bradley Siderograph CITs (HERE)

Sep 03 (Thu), Sep 05 (Sat), Sep 24 (Thu), Sep 29 (Tue)

Planets vs Galactic Center (HERE)

Sep 20 (Sun) = SUN 90° GC

SUN and Planets @ 14°Cancer (HERE)

Sep 20 (Sun)

Natural Trading Days (HERE)

Fall Equinox = Sep 23 (Wed)

Radio Flux 10.7 cm Forecast CITs (HERE)

Sep 1 (Tue), Sep 4 (Fri), Sep 11 (Fri), Sep 20 (Sun), Sep 30 (Wed)

Sensitive Degrees of the SUN (HERE)

Sep 02 (Wed) 15:04 = SUN @ 10° VIR -

Sep 04 (Fri) 16:38 = SUN @ 12° VIR +

Sep 05 (Sat) 17:23 = SUN @ 13° VIR -

Sep 21 (Mon) 03:08 = SUN @ 28° VIR +

Sep 25 (Fri) 05:15 = SUN @ 02° LIB -

|

| 10.7 cm Flux is considered a sunspot-proxy. Source: NOAA |

Labels:

10.7 cm Radio Flux,

AstroFin,

Astronomy,

Bradley Index,

Bradley Siderograph,

Cosmic Cluster Days,

Declination,

Latitude,

Market and Solar Activity,

Planets @ 14°Cancer,

SoLunar Map

Thursday, August 27, 2015

SPX vs Sunspots

Labels:

10.7cm Flux,

AP,

AstroFin,

Financial Astrology,

Market and Solar Activity,

NOAA,

SPX,

Sunspots,

US-Stocks

Wednesday, August 26, 2015

SPX vs SUN-JUP Cycle

|

| The SoLunar Map signals a turn down today. Well, the Shanghai Stock Exchange Composite Index (SSEC) did tank again. |

|

| Calculated and charted with Timing Solution. |

Labels:

AstroFin,

Financial Astrology,

Jupiter,

SPX,

Sun,

Timing Solution,

US-Stocks

Expected Future S&P 500 Earnings

|

| Source: Political Calculations |

Labels:

Political Calculations,

Quarter Earnings,

SPX,

US-Stocks

China bigger Risk than Lehman, Greece, US Fiscal Problems?

|

| Source: Torsten Sløk, Deutsche Bank Securities - found @ Barry Ritholtz |

Labels:

Barry Ritholtz,

China,

Debt Crisis,

Deutsche Bank,

Greece,

Torsten Sløk,

VIX,

VVIX

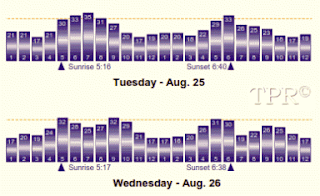

SPX vs Planetary Hours + SoLunar Intraday Map (Aug 25-26)

Labels:

AstroFin,

Financial Astrology,

Intraday,

Planetary Hours,

SoLunar Intraday Maps,

SoLunar Map,

SPX

Subscribe to:

Posts (Atom)