We do not need to be rational and scientific when it comes to the details of our daily life—only in those that can harm us and threaten our survival. Modern life seems to invite us to do the exact opposite; become extremely realistic and intellectual when it comes to such matters as religion and personal behavior, yet as irrational as possible when it comes to matters ruled by randomness (say, portfolio or real estate investments). I have encountered colleagues, "rational," no-nonsense people, who do not understand why I cherish the poetry of Baudelaire and Saint-John Perse or obscure (and often impenetrable) writers like Elias Canetti, J. L. Borges, or Walter Benjamin. Yet they get sucked into listening to the "analyses" of a television "guru," or into buying the stock of a company they know absolutely nothing about, based on tips by neighbors who drive expensive cars.

Sunday, July 31, 2022

On Randomness, Uncertainty, and Probability | Nassim Nicholas Taleb

We do not need to be rational and scientific when it comes to the details of our daily life—only in those that can harm us and threaten our survival. Modern life seems to invite us to do the exact opposite; become extremely realistic and intellectual when it comes to such matters as religion and personal behavior, yet as irrational as possible when it comes to matters ruled by randomness (say, portfolio or real estate investments). I have encountered colleagues, "rational," no-nonsense people, who do not understand why I cherish the poetry of Baudelaire and Saint-John Perse or obscure (and often impenetrable) writers like Elias Canetti, J. L. Borges, or Walter Benjamin. Yet they get sucked into listening to the "analyses" of a television "guru," or into buying the stock of a company they know absolutely nothing about, based on tips by neighbors who drive expensive cars.

Saturday, July 30, 2022

Trading the S&P 500 with the Lunar Cycle | Randall Ashbourne

[...] What I discovered was that, statistically, the old assertions not only hold up, but when traded consistently over time, produce big profits for small amounts of time exposed to market conditions [...] Buying a single share of the index at the closing price of our starting date on the January 4 New Moon and holding until the close of the June 1 Solar Eclipse New Moon, produced a profit of $44.35 - 3.49% (bottom left corner of the table).

[...] Staying OUT of the market during all New Moon-Full Moon phases would have protected us from losing some of our buy-and-hold gains … but delivered much better profits for our Loonytoons strategy by being profitable Short trades. We were in the market ALL the time, but continually reversing positions - to get three times the profit of buy-and-hold. The darker green coloring shows the very profitable trades, the light green shows profitable trades. The rose coloring shows that only ONE “assumed” Short phase would have resulted in a trading loss. But, remember … this is overall, taking into account the full 6 month period.

[...] take advantage of the Quarter Moon dates. So, our trading strategy now becomes to open 1 position at either the New Moon or Full Moon, but to add an extra position at the First Quarter or Third Quarter date. And the table below shows a significant boost to our potential profits: Instead of relying totally on the 14 day Short from NM-FM, we add one extra Short at the 1Q Moon - boosting the overall profit from Short trades from $46.61 to $109.36. And we adopt the same strategy when we reverse to Long trades at the Full Moon - 1 Long at Full Moon and one extra Long at 3Q Moon, boosting our Long profits to $152.56.

The Lunar Cycle | Carol S. Mull

The Sun and the Moon are in square aspect (90°) during the first and last quarters, in opposition (180°) at the Full Moon, and in conjunction (0°) at the New Moon. They are in sextile (60°) between the New Moon and the first quarter and between the last quarter and the New Moon. For precise work, compute a heliocentric chart for the times that the Moon, Earth, and Sun are in exact aspect. Unless there are other overshadowing influences, trines (120°) and conjunctions will be up, squares will be down, oppositions will be somewhat up, and sextiles can be either direction.

Most financial astrologers will tell you that oppositions (Full Moons) will sent the market down, but my experience does not verify this. Apparently, the momentum of being between two trines will carry the opposition along. If the next aspect following a sextile is a conjunction, the sextile is likely to correlate with an upward movement. But if the aspect following a sextile is a square, the sextile is likely to be accompanied by a downward-moving market.

Another lunar cycle concerns the elements. The market tends to move up whenever the Moon is in an Air [Gemini, Libra, Aquarius] or Fire sign [Aries, Leo, Sagittarius] and to move downward whenever the Moon is in an Earth [Taurus, Virgo, Capricorn] or Water sign [Cancer, Scorpio, Pisces]. Other recent experiments have attempted to be the Moon's velocity and the angular rates of positive acceleration or negative acceleration to the market. These have been inconclusive.

Carol S. Mull (1989) - Mercury and the Dow. In: Traders World, #4915, Issue #15.

Ilia D. Dichev and Troy D. Janes (2003) - Lunar Cycle Effects in Stock Returns

AstroSeek.com (2022) - Monthly Lunation Cycle

AstroSeek.com (2022) - Monthly Astro Calendar

|

| HERE |

|

| HERE |

|

| HERE |

Tuesday, July 26, 2022

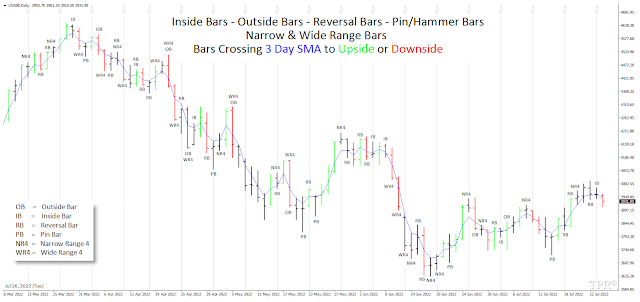

Range, 3 Day SMA, Day Counts & Reversal Harbingers

A day in which there is a new high followed by a lower close

is a downwards reversal day (RB). An upwards reversal day is a new low followed by a

higher close. A reversal day by itself is not significant unless it can be put

into context with a larger price pattern, such as a clear trend with sharply

increasing volatility, or a reversal that occurs at the highest or lowest price

of the past few weeks. Short-term reversals are likely after wide-ranging (WR4) and narrow-ranging days (NR4), especially when the open, high, low and close of the daily price bar are altogether above or below of a simple three-day moving average line of daily close prices.

A wide-ranging day is likely to be the result of a price shock, unexpected news, or a breakout in which many orders trigger one another, causing a large increase in volatility. A wide-ranging day could turn out to be a spike or an island reversal. Because very high volatility cannot be sustained, a wide-ranging day will likely be followed by a reversal, or at least a pause. When a wide-ranging day occurs, the direction of the close (if the close is near the high or low) is a strong indication of the continued direction. An outside day (OB) often precedes a reversal. An outside day can also be a wide-ranging day if the volatility is high, but when volatility is low and the size of the bar is slightly longer than the previous bar, it is a weak signal. As with so many other chart patterns, if one day has an unusually small trading range, followed by an outside day of normal volatility, there is very little information in the pattern. Context and selection are important.

Tuesday, July 12, 2022

Playing the Field: Lunar Effects on Mood and Biology | Michael Bevington

The greatest change in the electric field potential occurs as the moon crosses into and out of the magnetotail plasma, which occurs 2-3 days before the full moon and 3-4 days after the full moon.

Some of the reported effects of the full moon on animal and plant biology: tree diameter variation reflects a lunar rhythm; reproduction; changes in the stress hormone; epileptic seizures and unexpected deaths increase during full moon; increase of violent and acute behavioral disturbances during full moon, etc.

Sunday, July 10, 2022

Three Bar Patterns: The Smallest Fractals of Market Structure | Larry Williams

- A Short-Term High (STH) is a bar with a high greater than or equal to the high of the bar to the left and greater than the bar high to the right. Neighboring bars should not be inside. If they are inside bars, the bars that follow them should be analyzed.

- A Medium-Term High (MTH) has Short-Term Highs to the left and and to the right that are below the high of this bar.

- A Long-Term High (LTH) has Medium-Term Highs to the left and and to the right that are below the high of this bar.

And for the lows, it's the opposite:

- Short-Term Low (STL) = bar with higher lows on both sides

- Intermediate-Term Low (ITL) = higher STL on both sides

- Long-Term Low (LTL) = higher ITL on both sides

In other words, three bar patterns are the smallest fractals and building blocks of market structure. Since price is always either in consolidation, an uptrend, or a downtrend, three successive price bars must form either a directional pattern (higher highs, higher lows, or vice versa), a continuation pattern (e.g., also including an inside bar), or a reversal pattern (e.g., outside bar, pin bar, head & shoulders, V, A, or M&W patterns)(see also HERE):

Tuesday, July 5, 2022

Inside Days in the S&P 500 │ Toby Crabel

Toby Crabel (1990) - Computer studies suggest that Inside Days (ID) provide very reliable entries in the S+P market. The data used in the studies is daily open, high, low and close prices from 1982 to 1987. All of the following patterns are defined for a computer but can be seen easily on a daily bar chart.

- Pattern (1) is simply an inside day followed by a sale (s) on a lower open or buy (b) on a higher open. Entry is on the open with an exit on the same day's close with no stop. This procedure produced sixty-eight percent winning trades with profits of $18,000 after an $18 commission. This is a reasonably high percentage and suggests a strong bias in the direction of the open after any ID.

- Pattern (2a) is defined as an ID with a higher close than the previous day followed by a higher open. A buy is taken on the open and exited on the close. The same is done on the sales (Pattern (2b)) if there was an ID with a lower close followed by a lower open. Again, stops were not used. There were forty-four trades as such with seventy-four percent of them profitable. Net profit was $14,914. The percentage has improved and profits are better per trade than Pattern (1). This supports the premise that the closing effects the next day's action and potential breakout. Further tests uncover some variations to above results. Although the opening direction after an inside day appears to be a valid indicator of upcoming direction, there are same specific patterns that show very high percentage profitability without the use of the previous day's closing direction. Specifically, two patterns; one a sale (Pattern (3)), one a buy (Pattern (4)).

- Pattern (3): The day of entry is called Day 1. The day of immediately preceding the entry is Day 2 and each preceding day - 3, 4, 5, etc. On Day 1 an open lower than Day 2's mid-range and lower than Day 2's close is necessary. Day 2 must be inside of Day 3. Day 3 must have a higher low than Day 4. A sale is made on the open of Day 1 with exit on the close of Day 1. Profits were eighty percent with winning trades five times the size of losing trades. The only shortcoming is that only ten trades could be found from 1982-1987.

- Pattern (4) is similar to Pattern (3) with opposite parameters. The only exception is the open on Day 1 need only to be higher, not above mid-range. So to review Pattern (4), Day 1 a higher open than Day 2. Day 2 inside Day 3. Day 3 lower high than Day 4. Results were as follows: Ninety-one percent profits; 860 to 820 average winner to average loser. No stops were used. Only eleven patterns to the upside were found.

The market action implied in each pattern is a short-term trend with a loss of momentum on the Inside Day. The open on Day 1 is in the opposite direction of the trend and is an indication of a shift in sentiment. This shift in sentiment causes those who still have existing positions against the opening direction to liquidate longs or cover shorts. Participants covering their positions is more than enough to tip off a directional move.

A slightly different perspective on the same type of pattern is to look for a retracement to the previous day's close after the opening and take a position at that point in the direction of the open. I tested four patterns to demonstrate this principle.

- Pattern (5) shows an Inside Day with a lower close on Day 2 than Day 3. Day 1's open is above Day 2's close. The chances are sixty-two percent that the market will close above Day 2's close on Day 1.

- Pattern (6) is an Inside Day on Day 2 with a higher close than Day 3. Day 1's open is above Day 2's close. The chances are seventy-nine percent that the market will close above Day 2's close on Day 1.

- Pattern (7) shows an Inside Day on Day 2 with a lower close than Day 3's close. Day 1's open is below Day 2's close. The chances are fifty-nine percent that the close on Day 1 will be lower than Day 2's close.

- Pattern (8) shows an Inside Day on Day 2 with a higher close than Day 3's close. Day 1's open is below Day 2's close. There is a sixty-seven percent chance that the market will close below Day 2's close on Day 1.

How can you use this information? It suggests a strong bias in the direction of the open especially after a higher open. The prolonged bull market obviously had an impact on these results but in general, a counter move back to Day 2's close after the opening direction is known, should be observed for a loss of momentum and possible entry in the direction of the open.

Another totally different test in the S+P has same interesting implications and could be tied in with the previous patterns. On any day that the market has moved two hundred points above the open intra-day, it has closed above the open ninety percent, of the time. Also, on any day that the market has moved two hundred points below the open it has closed below the open eighty-eight percent of the time. This was during the period from 1982-1988.

An application of these results is as follows: Enter in the direction of the initial trend on any low momentum move back to the open and exit on the close of the session. This can be done after the initial trend is established with a two hundred point move in one direction off the open. The main qualification is price action on the pullback. A high momentum move back through the open leaves the initial two hundred point move in question. This can also be applied after an Inside Day very effectively.

I think it is necessary to shed light on how extraordinary the results for Inside Days are: A test on a sale of a higher open or buy of a lower open with no other information to work with provides a winning trade fifty-six percent of the time when exiting on the close the same day of entry. This suggests a natural tendency for the market to reverse the opening direction by the time of the close.

This natural tendency is reversed after an ID. Why? What is it about an ID that produces follow through after the open? An ID is narrower than the previous day. Any narrowing day shows loss of momentum and when within a previous day's range it forms a congestion area. A congestion is directionless trade with the market searching for new information. A temporary state of balance or equilibrium exists.

There is a tendency for the market to trend after a congestion. If an Inside Day is a valid congestion, it will produce an imminent trend day. One can assume from the above tests that there is a tendency to trend after these patterns (ID). These tests support the premise that Inside Days are valid congestion areas. It appears that market participants act on the first piece of information indicating trend after the Inside Day - the open. Also, the direction of the close on the ID will provide further clues on the direction of the breakout when added to the information of opening direction. The increase in percentage profit and relative profits when these variables are added supports this conclusion.

Why do these indications work so well in the S+P? The S+P generally is an urgent market. The distinguishing characteristic of this market is its tendency to trend throughout the session. This market is notorious for big, fast moves intra-day. Peter Steidlmayer (Markets and Market Logic) calls it a One-Time Frame market. One may reason that in a One-Time Frame market the inside day is a more reliable indication of upcoming trend than in a Two-Time Frame market. The market principle that is in force is contraction/expansion. The Inside Day is contraction, and in a One-Time Frame market 1-Day contraction is all that is necessary to tip off a directional move.

In summary, the above tests suggest that an Inside Day is a valid congestion area and it follows that all breakout rules for congestion areas should be implemented after an Inside Day forms. The resulting breakout is expansion.

|

| Three-Bar Inside Bar Pattern by Johnan Prathap - HERE & HERE |

[...] The Principle of Contraction / Expansion is defined as the market phenomenon of change from a period of rest to a period of movement back to a period of rest. This interaction between the phases of motion and rest are constantly taking place, with one phase directly responsible for the others' existence. A Trend Day is defined as a day when the first hour's trade comprises less than 10% of the day's range or the market has no dominant area of trade throughout the session. Trend days are characterized by an opening near one extreme and a close on the opposite extreme of the daily range. Trend days fall into the category of expansions. Congestion is a series of trading days with no visible progress in either direction. Usually associated with narrow range days or non-trend days. Contraction is a market behavior represented by a congestion or dormant period either short-term (ID) or long-term narrow range (8 Bar NR) and usually reaching its narrowest phase at the end of the period.

Monday, July 4, 2022

There Are Only 8 Possible Range Patterns in Any Bar Chart | Larry Williams

- Down Range: Last Bar's high is lower than prior Bar's high; and last Bar's low is lower than prior Bar's low.

- Up Range: Last Bar's high is higher than prior Bar's high; and last Bar's low is higher than prior Bar's low.

- Inside Range: Last Bar's high is lower than prior Bar's high; and last Bar's low is higher than prior Bar's low. On a Daily S&P500 Chart this occurs approximately 12% of the time.

- Outside Range: Last Bar's high is higher than the prior Bar's high; and Bar's low is lower than the prior Bar's low. On a Daily S&P500 Chart this occurs approximately 12% of the time.

Price action cannot occur in any other way. Within these 4 Range Patterns each last bar can either be an up bar or a down bar. So there are actually 8 possible Range Patterns:

1. Down Range, Down Day

2. Down Range, Up Day

3. Up Range, Down Day

4. Up Range, Up Day

5. Inside Range, Down Day

6. Inside Range, Up Day

7. Outside Range, Down Day

8. Outside Range, Up Day

Stop Loss: Based on $ Stop.

Exit: First Profitable Opening.

It was also found that a Down Range Larger Range day was better than a Down Range smaller Range day. $205 Avg 80% Win, vs $33 Avg 85% win,

Also naked close was better than a covered close (naked close meaning that the close was outside of the previous day’s range). $155 Avg 83% Win vs $30 Avg 83% Win. And combining these two concepts:

Down Range, larger range, Naked close: $215 Avg, 85% Winners

Friday, July 1, 2022

ICT Intraday Trading Templates | Daily and Weekly Market Maker Cycles

Great activity and breadth induces trading in large quantities by big operators on the floor and outside. Such a market enables the manipulator to unload a large line of stock. When he wishes to accumulate a line, he raids the market for that stock, makes it look very weak, and gives it the appearance of heavy liquidation by sending in selling orders through a great number of brokers.

You say all this is unethical, if not unscrupulous. You say it is a cruel and crooked game. Very well. Electricity can be very cruel, but you can take advantage of it; you can make it work for your benefit. Just so with the stock market and the Composite Man. Play the game as he plays it. « — Richard D. Wyckoff, 1931

While these banks also engage in speculative trading, the majority of their activity is classified as "market making." This entails buying and selling on behalf of their clients, which primarily include hedge funds, pension funds, commercial banks, corporations, other financial institutions, and central banks. In fact, central banks are among their most valued clients. The sheer volume of their orders means that transactions cannot be executed in single lots in any market, necessitating the roles of market makers and liquidity providers. Big banks earn commissions from these activities, often risking their clients' capital for market manipulation and additional profits.

This information is crucial for small retail traders as it reveals an important insight: if the major banks primarily act as market makers and liquidity providers, they inherently drive the market toward areas of liquidity. Market movements are not random; they are influenced by intention, logic, strategy, and measurable factors. Price levels can be predicted. Michael J. Huddleston, the Inner Circle Trader (ICT) and author of many smart money trading concepts, emphasizes this understanding:

» There

is always a puppeteer. There is always someone pulling the strings.

It's never being left to randomness of buying and selling. There is no support and resistance in the marketplace. These are

all notions that promote the idea of free trade. When it comes to the truth of the markets: It's

complete and utter control and manipulation. It's a very simple approach. It's about price: It's the open, the high, the low, and the

close of the daily, weekly, monthly and quarterly bars. It's not support nor

resistance what is moving the price order flow. It's all about where the

money is. The retail textbooks will never teach you this: Price moves to where the

money is. And the money is at the levels where most retail traders have

their entry and stop loss orders - just to get harvested by the smart money during false moves and false breakouts. «

The good news is that market makers consistently leave footprints within their accumulation-manipulation-expansion-distribution framework. These include order blocks, imbalances, fair value gaps, liquidity voids, liquidity pools, stop runs, and equilibrium. (HERE - HERE - HERE)

Big banks rely less on indicators and employ more software engineers and programmers than technical analysts, and for good reason: market making and order processing are fully automated by algorithms designed to maximize returns. They utilize daily, weekly, monthly, quarterly, and yearly charts, largely ignoring popular retail indicators, forecasting methods, and trading systems. Their market-making strategy focuses exclusively on breaking down large orders into smaller increments, executing these transactions continuously and efficiently, and profitably misleading retail traders.

Smart money drives the markets in daily and weekly cycles, with accumulation, manipulation, expansion, and distribution as their core business model. The typical weekly market maker cycle is as follows:

(1.) The week starts with a trap move on Sunday night or early Monday morning.

(2.) Then follows an 'accumulation phase' and the setting up of an initial high and an initial low in the Asian session, during which price is usually held in a narrow range.

(3.) The accumulation phase is followed by what Wyckoff coined the 'spring', an engineered false breakout against the real intention of the market maker to 'support or resistance levels' to harvest the retail traders' entry and stop loss orders there. The market maker considers these levels as 'liquidity pools'.

(4.) Next the market maker initiates the actual planned market move. This results in the formation of a trend that can be slow and steady, or it could be swift and furious. In the cash market a trend can be just a few hours, in the futures market up to 8 or 10 hours. On the chart the trend will be seen as a series of drives or pushes in the market maker's intended direction.

(5.) Towards the end of the day or the end of the session, there will be a corrective distribution phase and pattern of some type (wedge, pennant, head and shoulders, M or W formation), when price pulls back from the high or the low of the day because the market maker liquidates positions (see also HERE).

There is a high probability that the weekly low or high will form before the opening of the New York session on Wednesday. The odds increase further between Tuesday and Wednesday, particularly during Tuesday's London session leading into Wednesday's New York session. Even market makers do not possess infinite capital, so they must orchestrate retracements to secure profits before continuing their strategies. This is why sudden, aggressive pullbacks can seem to occur out of nowhere.

To gain a more detailed understanding of how smart money manipulation operates on a day-to-day basis, Michael J. Huddleston has developed six ICT Intraday Trading Templates. These templates offer insights into when to expect market movements, clues related to daily and weekly biases and ranges, and a perspective on the internal structure of daily and weekly market maker cycles:

(1.) The Classic Buy or Sell Day Template: This is the best template to make money since it is a wide range trending day that unfolds mostly on Monday, Tuesday and latest on Wednesday during the London session. The New York session will eventually give a retracement to continue with the trend that was set during the London session. The daily range will last for 7 to 8 hours once the profile is established.

Mostly it will give a rally or drop from the daily opening price to the low or high of the day during the London session. The trend usually lasts into 11:00 EST.

Price will initially drop below the opening price, then run above the opening price and go back to the range into consolidation. It first appears to unfold as the Classic Buy or Sell Template. But if it continues consolidating, do not look for continuation into the New York session. Take profits.

(3.) The London Swing to New York Open / London Close Reversal Template: The bullish version of this template always begins like a Classic Buy or Sell template with a decline below the opening price before price starts rallying. Once price drops, a buy entry forms, price rallies to a higher time frame Point of Interest (POI), e.g. a bearish order block (OB), into a Fair Value Gap (FVG), etc. If this happens during the New York session, it indicates a classic market reversal.

The template is used to either reach for a bearish order block on a higher time frame, for a turtle soup raid or to close a range. On a bullish day it will first create an initial low of the day during the London session, run up and create the high of the day during the New York session around the London Close, then run back down and clear the initial low that was created during the London session. Ideally it can pan out after the market is in exhaustion based on the higher time frame's dominant trend.

(4.) The Range to New York Open / London Close Rally Template: Generally this template is to be expected on days with high or medium impact news events like interest rate announcements, etc.

Ahead of these events price will remain in consolidation during the Asian and London sessions. Lows will be cleared initially and after the news price explodes into a directional move.

(5.) The Consolidation Raid on News Release Template: Unfolding during the New York session on days with high impact news, mostly FOMC press releases. During and shortly after the news old highs and lows of prior consolidation levels will be taken out. Ideally buy when a low is taken out and sell when a prior high was breached.

.png)