Saturday, July 5, 2025

The NAAIM Index vs the S&P 500 | Branimir Vojcic

Sunday, April 6, 2025

"Please, It’s Too Much Winning. We Can't Take It Anymore, Mr. President!"

» There’s a fantastic research paper called “Buffett’s Alpha”, which analyzes the “factors” that Buffett tilts towards. Buffett is exposed to the Betting-Against-Beta and Quality-Minus-Junk factors, with 1.7x leverage. I highly recommend you read this. «

Krasi: Weekly Preview, April 5, 2025.

Friday, December 6, 2024

Memo from the Chief Economist: Lament of a Bear | David Rosenberg

The bottom line: Tip the hat to the bulls who have, after all, been on the right side of the trade, and provide some rationale behind this powerful surge. This is not some attempt at a mea culpa or a throwing in of any towel, as much as the lament of a bear who has come to grips with the premise that while the market has definitely been exuberant, it may not actually be altogether that irrational. Read on.

See also:

Steve Miller (December 5, 2024) - S&P 500 Cycle Analysis - Time and Price Projections Update.

Wednesday, December 4, 2024

December Stock Market Performance in Election Years | Jeff Hirsch

Trading in December is typically holiday-inspired, driven by a buying bias throughout the month. However, the first part of the month tends to be weaker due to tax-loss selling and year-end portfolio restructuring. Over the last 21 years, December’s first trading day has generally been bearish for both the S&P 500 and the Russell 2000. A modest rally through the sixth or seventh trading day often fizzles out as the month progresses. Around mid-month, however, holiday cheer tends to take over, and tax-loss selling pressure fades, pushing the indexes higher with a brief pause near the end of the month. In election years, Decembers follow a similar pattern but with significantly larger historical gains in the second half of the month, particularly for the Russell 2000.

This serves as our first market indicator for the New Year. Years when the SCR fails to materialize are often followed by flat or down markets. Of the last seven instances where our SCR (the last five trading days of the year and the first two trading days of the new year) did not occur, six were followed by flat years (1994, 2004, and 2015), two by severe bear markets (2000 and 2008), and one by a mild bear market that ended in February 2016. The absence of Santa this year was likely due to temporary inflation and interest rate concerns that quickly dissipated. As Yale Hirsch’s now-famous line states, “If Santa Claus should fail to call, bears may come to Broad and Wall.”

Monday, December 2, 2024

AAII Bull-Bear Spread Signals Bullish Outlook | Duality Research

Friday, February 16, 2024

S&P 500 vs NAAIM Exposure Index │ ISABELNET

Tuesday, July 18, 2017

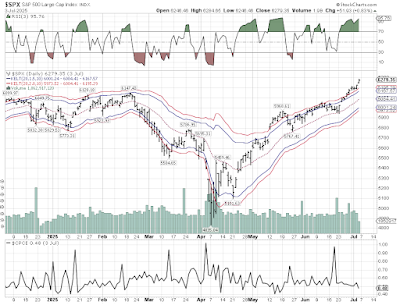

SPX vs CBOE Equity Put / Call Ratio │ Extreme Greed

On Friday, July 14th the CBOE Equity Put / Call Ratio closed at 0.53, signalling extreme greed. On Monday, July 17th the SPX performed a narrow range inside day (IDnr 4 and IDnr7), and closed forming a neutral doji candle. However, on July 17th the CBOE Equity Put/Call Ratio closed at 0.63, and the 3-Day Moving Average (blue line) is about to turn up (down on the inverted scale).

Wednesday, June 8, 2016

SPX | Extreme Greed but Room to the Top

|

| The VIX (CBOE volatility index) revisited the Oct 28, 2015 low at 12.8 and reversed to the upside, while the SPX formed a NR4, and a doji candle. June 8 (Wed) is 118 CD (4 Lunar Cycles) from the major low on Feb 11, 2016. The SoLunar Map points to a high on June 9 (Thu). There is a cluster of 3 potential Jack Gillen turn days from June 6 to 8. Since June 10 (Fri) is a Cosmic Cluster Day, the indices may keep chopping up into Thursday or even Friday. Please note: The NYSE McClellan Oscillator and the the McClellan Ratio Adjusted NYSE Summation Index are still rising (HERE + HERE) |

|

| Credits: CNN Fear & Greed Index |

Wednesday, September 30, 2015

Contrarian Riddle

|

| The one sentiment reading that is NOT contrarian just turned bearish (above 50 = bullish, below = bearish) ... Source: Market Vane via @Not_Jim_Cramer |

|

| ... while FT covers like this one reliably show up when market bottoms are close-by or already in. |

.png)