After price had risen significantly in recent weeks, Ethereum reached new interim highs at USD 4,070 on August 8, but may now be approaching a medium-term correction.

Ethereum (weekly bars): Major resistance zone around USD 4,107.

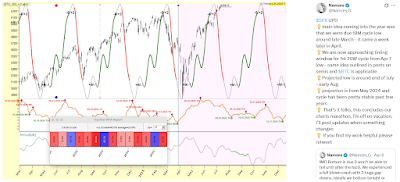

The stablecoin market volume stood at USD 250 billion on July 23 and is currently growing by roughly USD 5 billion per week. It has already reached approximately USD 280.8 billion. Over 50% of all stablecoins operate on the Ethereum blockchain – a factor seen as clearly positive for Ethereum. Capital flows show significant inflows into Ethereum ETFs in recent weeks. A notable divergence is visible between retail investors and large investors (institutions/whales):

ETH (black line) Number of Addresses with Balance ≥ 10k (blue line) sharply rising:

The whales are eating Ethereum alive.

■ Retail investors have been steadily reducing their Ethereum holdings for months, even during recent price gains.

■ Large investors, on the other hand, have been accumulating heavily.

■ Number of addresses holding more than 10,000 ETH – currently worth around USD 40 million each – has risen sharply.

This is interpreted as a long-term bullish signal: “smart money” is buying while “dumb money” is selling.

Short-term price may reach USD 4,200–4,300, followed by a quick pullback.

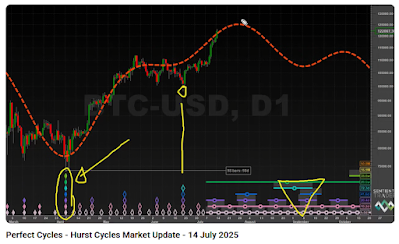

From a technical perspective, there is a major resistance zone around USD 4,107 that has repeatedly triggered sharp corrections in the past. In the short term, price could reach this area or slightly exceed it (up to about USD 4,200–4,300). A breakout above this level might attract momentum traders, potentially followed by a quick pullback.

The expected correction could, depending on the exact high, amount to USD 1,000–1,300, bringing the price down to the USD 3,000 range or lower. This phase is viewed as a buying opportunity.

A correction down to around USD 3,000 should be followed by a medium-term

rise to USD 5,500–6,500 and long-term targets of USD 12,000–14,000.

In the medium term, after the correction, another upward move is anticipated, with targets between USD 5,500 and 6,500. In the long term price regions of USD 12,000–14,000 are considered possible. Exact timing cannot be derived from Elliott Wave analysis, as price movements and patterns can vary greatly in duration.

Reference:

favoring ETH’s outperformance vs. BTC through ~2028.

.PNG)

.PNG)