Michael J. Huddleston, born 1964 in St. Joseph, Michigan, and widely known as ICT (The Inner Circle Trader), is an American trader and educator who developed Smart Money Concepts (SMC), a methodology that interprets institutional price action in markets such as forex, commodities, indices, and crypto. Beginning his trading journey in the 1990s after being introduced to futures and options by an uncle, he endured early failures—including a major loss in orange juice options—before refining his approach through mentorship and extensive study.

His most formative influences were stock market trader, broker, and investor Richard Demille Wyckoff (1873–1934), legendary trader and market technician Larry Williams, Forex trader and educator Steve Mauro, and former Canadian Olympic bobsledder turned institutional forex trader Cris Lori, who shaped Huddleston’s understanding of price action, market timing, and liquidity.

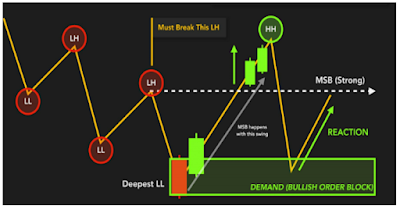

Huddleston believes price action is governed by algorithms that target liquidity zones like order blocks and fair value gaps. Over the years, he has become an influential figure in retail trading education, coining concepts like Order Block, Fair Value Gap, Market Structure Shift, Power of 3, and Optimal Trade Entry. Through his ICT YouTube channel and Twitter/X, he’s taught hundreds of thousands of traders, earning the nickname “mentor of your mentor.” Since COVID-19, Huddleston is said to have minted more millionaires than all US universities put together. His teachings stress patience, emotional discipline, and risk control, typically risking just 0.25% per trade.

How to Study ICT Price Action on YouTube | Darya Filipenka

This is Darya Filipenka's recommendation to study the ICT YouTube channel. She believes that this information is sufficient to understand how ICT concepts work.

ICT Price Action Concepts │ Aurthur Musendame

Only a few price action setups are essential to our method. These constitute the core elements of our trade setups—the framework surrounding the idea. Our four major price action elements, from which all our setups emanate, are: Consolidation, Expansion, Reversal, and Retracement.

Price always moves from Consolidation to Expansion, never from Consolidation to Reversal or from Consolidation to Retracement. When we see an Expansion, two possible scenarios can occur: either a Retracement or a Reversal, followed by another Expansion or Consolidation. That’s it—it happens over and over again.

The reference points for this framework are Order Blocks, Fair Value Gaps, Liquidity Voids, Liquidity Pools and Stop Runs, and Equilibrium.

Expansion and Order Blocks

Price usually makes fast moves or expands from Equilibrium Points leaving behind an Order Block. Later on when price returns or trades towards the order block we hunt for a reversal entry as it touches or perks through the Order Block.

USDCAD H4 Chart.

Retracement, Fair Value Gaps, and Liquidity Voids

After a sharp run in price, the large candles that form are the least efficiently traded areas in the range. Sudden price movements will leave gaps in the price action that tend to fill in at a later time. These small gaps can sometimes be seen by opening a 1-minute or 5-minute chart. This is described as a void of market liquidity, or a Liquidity Void.

Fair Valuation occurs when price trades back inside its current range and returns to levels it recently moved from—usually an order block, for example. Smart money tends to unload longs in this area while simultaneously establishing new shorts, or vice versa. This makes it a good location either to take profits or to enter a new position.

A Fair Value Gap occurs when price leaves a specific level and shows only a small section of price action that is seen as one directional. These can present very good areas for profit-taking or new setups.

Fair Valuation occurs when price trades back inside its current range and returns to levels it recently moved from—usually an order block, for example. Smart money tends to unload longs in this area while simultaneously establishing new shorts, or vice versa. This makes it a good location either to take profits or to enter a new position.

A Fair Value Gap occurs when price leaves a specific level and shows only a small section of price action that is seen as one directional. These can present very good areas for profit-taking or new setups.

When price trades in the opposite direction from where it has been after a rejection, this is termed a reversal, and it usually leads to a change in the direction of the trend. This signifies that Smart Money has triggered a level of stops, and a significant move should unfold in the new direction. We expect to see this unfold at peak formations, clean highs, and clean lows where liquidity pools reside, either in the form of buy stops or sell stops.

Macro Reversals: NZDUSD D1 Chart.

Equilibrium, Premium, and Discount

After a market has run lower and begins to reprice higher, we look for a rise above 50% or equilibrium, which indicates that the market is at a premium and frames ideal short setups. After a market has run higher and begins to retrace lower, we look for a fall below equilibrium or 50%, which indicates that the market is at a discount and frames ideal long setups. For this, we use the Fibonacci tool.

XAUUSD H4 Chart.

Low Resistance Liquidity Run

When Price has little resistance in its way to run an area of Liquidity. This is classically seen just under an Old High or above an Old Low. Price will surge sharply and typically on the release of an economic news release. High Probability setups are framed on the premise the market will have very little resistance in its path to run into obvious Liquidity Pools.

Defining Order Blocks

Breaker Block - Bearish: Best when found at major to intermediate term down trends. Bearish Breaker Block is a bearish range or Down Close Candle in the most recent Swing Low prior to an Old High being violated. The Buyers that buy this Low and later see this same Swing Low violated – will look to mitigate the loss. When Price returns back to the Swing Low – this is a Bearish Trade Setup worth considering.

Rejection Block - Bearish: This Bearish Rejection Block is when a Price High has formed with long wick(s) on the highs(s) of the candlestick(s) and Price reaches high above the body of the candle(s) to run Buy Side Liquidity out before Price Drops lower.

Vice Versa for Bullish RB.

Another example of a Rejection Block is a Turtle Soup buy or sell. This happens as a bearish run on buy side liquidity or bullish run on sell side liquidity.

Another example of a Rejection Block is a Turtle Soup buy or sell. This happens as a bearish run on buy side liquidity or bullish run on sell side liquidity.

Vacuum Block - Bullish Gap: This is created in Price Action as a result of a volatility event. The gap forms by a “vacuum” of liquidity directly related to an event. NFP (Nonfarm Payroll) can create a Vacuum Block or in futures a session opening can. Vice Versa for Bearish Gap.

Institutional Swing Points

There are mainly two types, namely stop runs and failure swings. These are the most powerful and most dynamic.

Stop Runs: The market trades to a key level or just short of it – but fails to immediately react indicating another run deeper before a reversal. After the reversal – the opportunity is best taken when the short term Market Structure breaking point is retested. First run on stops in an intermediate term price swing is ideal – smart money will look to unseat the aggressive trailing stops.

Failure Swings: The market trades through a ley level initially but fails to immediately continue – after rejecting the new price level – the market retraces only to attempt to stage another drive to retest the new price level. After the reversal, the opportunity is best taken when the initial key level is retested or after a market structure breaking point retested.

Framing Low Risk and High Reward Setups

Big Picture

- Macro Market Analysis: Inflationary and deflationary Markets.

- Interest Rate Analysis: Higher rates, lower rates and unexpected change.

- Intermarket Analysis: CRB Index for commodities and USDX for currencies (majors). 4. Seasonal Influences.

- Bullish and Bearish seasonal Tendencies.

- Top Down Analysis: Monthly, Weekly and Daily Chart Analysis.

- COT Data: Bullish and Bearish Hedging by Smart Money and Historical Extreme Levels.

- Market Sentiment.

- Extreme Market Bullishness and Bearishness.

Short Term

- Correlation Analysis: USDX SMT Analysis and Correlated Pair SMT Analysis.

- Time and Price Theory: Quarterly and Monthly Effects, Weekly and Daily Ranges, and Time of Day.

- IPDA – Inter-Bank Price Delivery Algorithm: Institutional Order Flow, Liquidity Seeking and Market Efficiency Paradigm.

Time Frame Selection and Model Setups

- Monthly Charts – Position Trading

- Weekly Charts – Swing Trading

- Daily Charts – Short Term Trading

- 4 Hour or Less - Day Trading

Setup Model

For long setups look for the following:

- Higher Time Frame Price Displacement – Reversals, Expansion or Return to Fair Value.

- Intermediate Term Imbalance In Price – Move To Discount or Sell Side Liquidity Run.

- Short Term Buy Liquidity Above The Market – Ideal For Pairing Long Exits To Sell To.

- Time of Day Influence i.e. London Open Low of Day or New York Low Formation

Vice Versa for Shorts.

Institutional Market Structure

Institutional Market Structure & Standard Deviations With Buyside Liquidity.

A. What Is Institutional Market Structure?

- The analysis of correlated assets or the relationship to inversely correlated assets.

- The purpose is to determine what the “Smart Money” is accumulating or distributing.

- Currencies are easy to analyse with Institutional Market Structure with the USDX.

- Every price swing should be studied to determine if Market Symmetry confirms it.

B. How Do We Identify Institutional Market Structure In Forex?

- Compare every price swing in the USDX with the Foreign Currency you trade.

- As USDX trades Higher, expect a Lower price swing in Foreign Currency pairs.

- If USDX or a Foreign Currency fails to move symmetrically – Smart Money is actively trading.

- As USDX trades Lower, expect a higher price swing in Foreign Currency pairs.

- If USDX or a Foreign Currency fails to move symmetrically – Smart Money is actively trading.

USDX SMT Divergence

Under Symmetrical Market conditions, when the USDX makes a lower low/HH, XXXUSD pairs make a higher high/LL. This makes a confirmation that the underlying trend is most “likely” to continue and therefore the idea of stalking reversal patterns here is low probability and should be avoided.

Under non symmetrical Market conditions, when the USDX make a lower low/HH and the XXXUSD pairs fail to make a higher high/LL, this fails to confirm current price action and the underlying trend is not likely to continue and the idea of stalking for reversals in this conditions is high probability and could reasonably be considered.

Interest Rate Effects on Currencies

A. Smart Money Accumulation & Distribution [Fundamentally Speaking].

- Interest Rates are the single most influential driving force behind market moves.

- Understanding Interest Rate Shifts & changes can assist you in selecting trades.

- Technical Analysis of key Interest Rates can unlock professional money movement.

- Interest Triads provide a visual depiction of Smart Money Accumulation & Distribution.

B. Interest Rate Triads

- 30 Year Bond – Key Long Term Interest Rate.

- 10 Year Note – Intermediate Term Interest Rate.

- 5 Year Note – Short Term Interest Rate.

- Overlaying or Comparative Analysis on these three Interest Rates unlocks Price Action.

- Failure Swings at opportunistic times can validate Institutional Order Flow

Interest Rate Triad

These are the 30 Year T Bond Market, 10 Year Note Market, and the 5 Year Note Market. Overlaying these three markets will highlight when Accumulation & Distribution in the Interest Rate Market takes place – from a “Smart Money” perspective. The three Interest Rates should confirm each higher high or lower low – at moments when the USDX is at a significant Price point. Failure swings highlight Smart Money participation in the markets & trading opportunities are validated. Simply put, look for SMT Divergence.

Note: 10 Y T-Note UP = 10 Y T-bond UP = USDX DOWN = Interest Rates DOWN

Action Plan: When price trades to a focus point like order blocks, liquidity voids or liquidity pool or fair value gap, refer to USDX and Interest Rate Triads (30 Y T Bond Market, 10 Y T Note Market, 5 Y T Note Market) to confirm if Smart Money is behind the trade idea you see unfolding. If there is no indication whether they are moving large funds –pass on.

Intraday Charts 4 hour and less will be correcting or retracing higher. This is where you anticipate the market to enter a Premium and seek Buy Side Liquidity to sell to. Protective Buy Stop Raids or price returns to Bearish Orderblocks or Fair Value Gaps and or filling of a Liquidity Void. Each offering a potential Low Resistance Liquidity Run – Shorting for a target under a recent Low.

Vice Versa for Bullish.

Vice Versa for Bullish.

ICT Long Term Analysis

The Quarterly Market Shifts

IPDA Data Ranges

We expect a major market shift every year, typically lasting 3 to 4 months. To identify Smart Money Accumulation for buy programs or Smart Money Distribution for sell programs, we analyze the manipulation occurring in the underlying asset relative to the benchmark. In simple terms, we look for SMT Divergence.

It is also crucial to perform a 20, 40, and 60-day lookback to identify institutional order flow by referencing recent institutional price points, such as previous price highs, previous price lows, bearish order blocks, bullish order blocks, and fair value gaps or voids.

It is also crucial to perform a 20, 40, and 60-day lookback to identify institutional order flow by referencing recent institutional price points, such as previous price highs, previous price lows, bearish order blocks, bullish order blocks, and fair value gaps or voids.

Open Float

Open float refers to the current open interest above and below the market price.

Short protective buy stops are placed above the last bearish shift — above the short-term highs, above the highest high in the last 3 months, above the current 6-month high, and above the current 12-month high.

Vice versa for long protective sell stops.

Short protective buy stops are placed above the last bearish shift — above the short-term highs, above the highest high in the last 3 months, above the current 6-month high, and above the current 12-month high.

Vice versa for long protective sell stops.

10 Y T-Notes (Treasury Notes)

Chart 10-Year Treasury Prices at www.barchart.com and 10-Year Treasury Yields at www.investing.com.

Treasury prices are inversely related to their yields: As treasury prices drop, treasury yields increase, and vice versa. Long-term funds seek yield; thus, the USDX can rally when yields decrease and treasury prices rise, and vice versa.

When the 10-Year T-Note and USDX move in tandem, there tends to be consolidation in currencies, with no clear trends. In such cases, we focus on stop raids and IPDA to identify previous highs and lows that may be violated on the lookback for both the USDX and T-Notes. During periods of consolidation, it is best to focus mainly on day trading rather than long-term trend trading.

If the USDX and T-Notes are moving in their typical seasonal patterns, we are more likely to see a long-term trend, which is where large funds typically place their money.

Use SMT divergence in relation to the USDX to qualify trade conditions with the 10-year yields.

Interest Rate Differentials

The macro perspective must begin with central bank interest rates, as these rates are set to stimulate or control inflation within a country's economy. The long-term macro strategy involves identifying a country with a high interest rate (IR) and pairing it with a country with a low IR. The respective currencies, when paired in a forex cross, are fundamentally positioned for strength relative to others.

Conversely, the opposite applies when pairing a low IR country with a high IR country. These pairs are fundamentally poised for weakness relative to other currency pairs.

Conversely, the opposite applies when pairing a low IR country with a high IR country. These pairs are fundamentally poised for weakness relative to other currency pairs.

Action Plan: Select two countries—one with a high IR and the other with a low IR—and define the forex pair coupling for trades. Look for strong support on a higher-timeframe (HTF) chart and wait for smart money signals indicating it is being bought. Confirm with seasonal tendencies and/or open interest. USDX directional confirmation will further qualify the trade.

Vice versa for selling.

World markets are directly linked to one another, and understanding them collectively aids in analysis. The four major groups in intermarket analysis are: currencies, commodities, the stock market, and bonds and interest rates.

USDX vs. Commodities: They are inversely related.

When the USDX goes up:

Bonds vs. Commodities: These markets are inversely related and are both inflation-driven. There is typically a lead or lag time of 6-12 months in long-term changes between them.

Intermarket Analysis

World markets are directly linked to one another, and understanding them collectively aids in analysis. The four major groups in intermarket analysis are: currencies, commodities, the stock market, and bonds and interest rates.

- Bonds and stocks typically move together.

- Commodities move inversely to bond prices.

- Currencies are influenced by commodities.

When the USDX goes up:

- Grains and agricultural exports tend to diminish,

- Stocks and bonds generally decline,

- Commodity currencies weaken.

- The reverse is also true.

- T-Bonds vs. CRB Index (with heavy agricultural and grain weighting)

- Use the Goldman Sachs Commodity Index (energy-weighted)

- Use the Goldman Sachs Industrial Index (for global trends)

When bond yields go up, commodities tend to rise. Conversely, when bond yields go down, commodities generally fall.

Bond vs. Stock Market: They have a positive correlation. Bonds act as a leading indicator for stock direction, with a lead/lag time of 6-12 months in long-term changes.

Deflationary Periods: Bonds tend to perform well as interest rates collapse. In this scenario:

Deflationary Periods: Bonds tend to perform well as interest rates collapse. In this scenario:

- Bonds go up,

- Stocks go down,

- Commodities decline.

Key Intermarket Relationships:

- USDX UP = Gold DOWN

- Gold UP = AUD & NZD UP (Gold exports)

- Oil UP = USDCAD DOWN (Canada is a leading oil exporter)

- Dow UP = Nikkei UP

- Nikkei Index DOWN = USDJPY DOWN

- Yields DOWN = Currency DOWN (Money seeks yield)

- Gold DOWN = USDCAD DOWN

Together, these relationships help confirm long-term analysis.

Seasonal Tendencies

Seasonal tendencies are merely a proverbial “roadmap” of past performance and they are not to be viewed as a panacea or be all end concept. They are not always respected but can be used if conditions permit. Ask yourself is there anything technically supporting the seasonal tendency.

Top Down Analysis

- Mitigation Block.

- Bullish/Bearish Breaker.

- Liquidity Void.

- Fair Value Gap.

- Bullish/Bearish Order Block.

- Rejection Block.

- Old high/low.

Buying with Stop Orders

The monthly and or weekly should suggest IOF will be seeking a PD Array above daily market price. The daily should post a bearish candle with a down close. Buy stop is placed at bearish candle open.

Vice versa for selling with stop orders.

Buying with Limit Orders

The monthly & or weekly should suggest IOF will be seeking a PD Array above Daily market price. The Daily chart must close the candle with a down close. Buy limit is placed at bearish candle close.

Vice versa for selling with limit orders.

Bullish Market Conditions

- Anticipate potential bullish seasonal tendency.

- Look for intermarket analysis confirmations.

- Refer to IR Yields direction to confirm.

- Consult HTF Monthly & Weekly chart for PDA.

- Expect a Quarterly Shift and intermediate swing.

- Use Daily PDA to frame your bullish setup.

- Determine if you will enter by stop or limit.

- Trail stop loss below the lowest low in last 40 trading days.

Vice versa for bearish market conditions.

Swing Trading Model

Swing Trading: This discipline involves trading predictable price movements with a high degree of consistency, buying during bullish conditions and selling during bearish conditions. Swing trading is an intermediate-term trading strategy, with trade durations typically lasting 2 weeks or longer.

The goal of swing trading is to capitalize on the impact of large entities entering a market and causing significant price displacement. Given the trade durations of 2 weeks or more, the potential rewards can be considerable, with trade objectives ranging from 200 to 500 pips or more.

However, not all markets are ideal for swing trading. In general, avoid favoring specific markets for swing trading. Large price movements tend to rotate in and out of different markets each year. There is no fixed "swing trading market" or currency pair. Every 3 months presents a new opportunity, and what was once a big mover may not be this time—so always investigate.

Market Profiles: These are crucial to identifying swing trading opportunities. Markets move through different profiles across all timeframes. On monthly and weekly charts, look for the current market profile of your markets of interest. Avoid markets that have been lackluster or lethargic, with little to no movement in the last 3 months.

Trending Markets = Large Flows: Look for markets that are trending. Markets confined to a narrow, obvious trading range generally do not offer high odds for directional setups. Build a watchlist of markets with trending profiles on the monthly or weekly charts, as this increases the probability of successful setups.

Be Willing to Err on the Direction: Avoid the temptation to pick tops and bottoms in price action. It is far more likely that the long-term trend will continue to influence price action than that a long-term reversal will occur. Focus on the prevailing long-term trend, and let the market tide carry your trade to the winner’s circle more often than not.

The goal of swing trading is to capitalize on the impact of large entities entering a market and causing significant price displacement. Given the trade durations of 2 weeks or more, the potential rewards can be considerable, with trade objectives ranging from 200 to 500 pips or more.

However, not all markets are ideal for swing trading. In general, avoid favoring specific markets for swing trading. Large price movements tend to rotate in and out of different markets each year. There is no fixed "swing trading market" or currency pair. Every 3 months presents a new opportunity, and what was once a big mover may not be this time—so always investigate.

Market Profiles: These are crucial to identifying swing trading opportunities. Markets move through different profiles across all timeframes. On monthly and weekly charts, look for the current market profile of your markets of interest. Avoid markets that have been lackluster or lethargic, with little to no movement in the last 3 months.

Trending Markets = Large Flows: Look for markets that are trending. Markets confined to a narrow, obvious trading range generally do not offer high odds for directional setups. Build a watchlist of markets with trending profiles on the monthly or weekly charts, as this increases the probability of successful setups.

Be Willing to Err on the Direction: Avoid the temptation to pick tops and bottoms in price action. It is far more likely that the long-term trend will continue to influence price action than that a long-term reversal will occur. Focus on the prevailing long-term trend, and let the market tide carry your trade to the winner’s circle more often than not.

Successful swing trading hallmarks:

- Obvious trend in HTF Charts.

- IOF on HTF Clear.

- IR market supports the trade.

- COT Data Confirms (enhances probability).

- Opposing PDA obvious in charts.

- Seasonal tendency (enhances probability).

- Supporting intermarket analysis.

Institutional Sponsorship: When entering a trade, look for signs of relative strength analysis to support the decision, such as SMT Divergence.

Bank Accumulation and Distribution

- Are the down candles turning into support, with higher prices following?

- Are the swing highs breaking and creating higher highs?

- Are the up candles turning into resistance, with lower prices following?

- Are the swing lows breaking and forming lower lows?

These observations can help identify whether institutional buying (accumulation) or selling (distribution) is occurring.

Clear Price Action and Levels

- Are the PDA (Price Delivery Areas) above or below the current market price clear and easy to identify?

- Are there levels that have not been traded in recent weeks or months, leaving an imbalance (based on monthly & weekly charts)?

- Clean price action is ideal because it minimizes distractions from erroneous movements and reduces the chance of being fooled by misleading signals.

- Price respecting institutional levels (e.g., 00, 20, 50, 80) suggests that the market is adhering to predictable levels of support and resistance.

Rule-Based Conceptual Methods

- Every trade must pass through a rule-based filtering process. The rules are standardized and static, not changing for each individual trade setup.

- If a trade setup fails the filtering process, it is discarded—no exceptions.

- If the setup passes the filtering process, the trade is executed.

Always Use the PD Array Matrix

- The PD Array matrix should align across monthly, weekly, and daily charts. If all three timeframes show a willingness to sell (e.g., a bearish array on Daily or H4) or buy (e.g., a bullish array on Daily or H4), then the setup is more likely to succeed.

- Avoid taking a buy or sell if the daily chart has just posted a higher high/lower low and rejected it as a breaker.

- The best swing trades are typically found at significant levels on the monthly and weekly charts.

Selecting Explosive Moves

- 1.) Major Market analysis one sided – Trending Profiles.

- 2.) Intermarket Analysis confluences.

- COT Hedging program Alignment.

- Open Interest.

- Seasonal tendency.

- Volatility filter confirms contraction.

- Major new headlines: sell bullish news and vice versa - use futures magazines.

- Markey sentiment: William %R on daily – 50% & below is oversold buy. vice versa for sell.

Short Term Trading

The short-term model can be both trend-based or range-based. The goal is to identify trades that are clear and easy to see as they form, rather than forcing trades. Short-term trading offers the highest probability setups, with frequent opportunities and consistent execution leading to a large number of potential trades.

Defining Market Conditions: When assessing market conditions, we think in terms of where the price can potentially reach—both in a rally and in a decline. This forms the foundation for determining the likely market direction. The PD Arrays that have been recently traded or executed indicate that the opposite PD Array spectrum is likely to be reached next.

- If the Discount Array has provided support, the probabilities increase that the Premium Array will be sought above the market price, and vice versa.

- We look for a monthly PD Array to align with the opposing weekly PD Array.

Execution Timeframe: The H1 (1-hour) timeframe is used for execution, offering precision in timing trades within the broader context defined by the monthly and weekly charts.

The General Concept revisited

Market is poised to trade higher on HTF:

- Seasonal tendency.

- Interest rate driven.

- Commitment of Traders.

- Intermarket analysis supports bullishness.

- Market rallies higher the retraces Monday –Wednesday.

- Market expands up to higher highs.

Monthly Ranges

Price is fractal, and HTF analysis benefits us as a result. We note the high and low of each monthly candle and consider the present range in terms of premium or discount. We also assess where the price on the monthly chart is likely to move next. There are generally four weekly candles within a monthly candle. Each week, we study where the monthly candle will likely trade next. Using the monthly ranges, we frame trades based on the weekly range.

Weekly Ranges

Price is fractal, and monthly analysis builds on the weekly. We note the high and low of each weekly candle and consider the present range in terms of premium or discount. We assess where the price on the weekly chart is likely to move next. There are generally five candles within each weekly candle. Each week, we study how the weekly candle trades within the monthly range. Using the weekly ranges, we frame trades on the daily chart.

Note: When the Monday-to-Wednesday high/low is traded through, price tends to expand aggressively toward the monthly and/or weekly PD Array.

Defining Weekly Range Profiles and Templates

Classic Tuesday low of the Week: Bullish

Manipulation: Hovers above a HTF Discount Array Monday then drops into the HTF Discount Array on Tuesday to form the low of the week.

Anticipation: Know the HTF Discount Array and when the market fails to drop into that array – odds are Tuesday will likely see the drive lower Tuesday London or New York Session.

Anticipation: Know the HTF Discount Array and when the market fails to drop into that array – odds are Tuesday will likely see the drive lower Tuesday London or New York Session.

Wednesday low of the Week: Bullish

Manipulation: Hovers above a HTF Discount Array Monday & Tuesday then drops into the HTF Discount Array on Wednesday to form the low of the week.

Anticipation: Know the HTF Discount Array and when the market fails to drop into that array – odds are Wednesday will likely see the drive lower Wednesday London or New York Session. Monday and Tuesday can be down days as well and form this profile.

Anticipation: Know the HTF Discount Array and when the market fails to drop into that array – odds are Wednesday will likely see the drive lower Wednesday London or New York Session. Monday and Tuesday can be down days as well and form this profile.

Consolidation Thursday Reversal: Bullish

Manipulation: Consolidates Monday through Wednesday then runs the intraweek low and rejects it forming a market reversal.

Anticipation: know the HTF Discount Array an when the market fails to drop into that Array – odds are Thursday will likely see the drive lower Thursday on a market driver News or rate release late New York Session around 2:00 EST.

Anticipation: know the HTF Discount Array an when the market fails to drop into that Array – odds are Thursday will likely see the drive lower Thursday on a market driver News or rate release late New York Session around 2:00 EST.

Consolidation Midweek Rally: Bullish

Seek and Destroy Bullish Friday: Bullish

Wednesday Weekly Reversal: Bullish

Manipulation: Consolidates Monday through Wednesday then runs the intraweek high and expands higher into Friday.

Anticipation: When the market is bullish and has yet to run to the Premium Array on the HTF timeframes and it has recently rallied from a discount Array and simply paused without any Bearish reversal Price Action. Indicating price is about to expand higher for the premium array.

Anticipation: When the market is bullish and has yet to run to the Premium Array on the HTF timeframes and it has recently rallied from a discount Array and simply paused without any Bearish reversal Price Action. Indicating price is about to expand higher for the premium array.

Seek and Destroy Bullish Friday: Bullish

Manipulation: consolidates Monday through Thursday – running shallow stops under and above the intra week highs – then runs the intra week High and expands into Friday.

Anticipation: when the market is waiting Interest Rate Announcement or NFP can create this profile in the summer months of July and August. Better to avoid trading these conditions.

Anticipation: when the market is waiting Interest Rate Announcement or NFP can create this profile in the summer months of July and August. Better to avoid trading these conditions.

Wednesday Weekly Reversal: Bullish

Manipulation: Consolidates Monday through Tuesday – drives lower into a HTF Discount Array to induce Sell Stops then strongly reverses.

Anticipation: When market is trading at a long term or intermediate term low – price will apir institutional buying with pending Sell Side liquidity. [Sell Stop Raids]

Anticipation: When market is trading at a long term or intermediate term low – price will apir institutional buying with pending Sell Side liquidity. [Sell Stop Raids]

Each week the market will seek to trade from one PD Array to the other. Typically the weekly range is completed by 30 – 50% inside Monday to Wednesday.

Intra-Week Market Reversals and Overlapping Models

- Wednesday or Thursday reversals can form monthly.

- Magnitude of Monday, Tuesday price movement – cautious: look at HTF Array because it can reverse huge.

- Reversals intraweek occur in overlapping models that’s why HTF PD Array Matrix is important: It can give you swing & or position trades.

- If market profiles oppose, HTF profile always wins.

One Shot One Kill Setups

The One Shot One Kill Setup (OSOK) requires:

- Power of 3 Concept applied to Weekly Candles or Ranges.

- Day of Week Concept – High or Low forms Monday to Wednesday 70% of the time.

- Using Fib for targeting & Understanding the concept of price points.

- Time of the day or ICT Kill Zones for entries on OSOK setups.

And everything learnt from the beginning so far.

OSOK Trade Procedure:

OSOK Trade Procedure:

- Determine the current or potential next Quarterly shift.

- Identify the HTF PD Arrays in the IPDA Data Ranges.

- Refer to the Interest rate differentials and Market Profile of Rates.

- Scout Seasonals throughout the calendar year that offer odds.

- Swing Analysis on the Price Action on HTF down to 60 min.

- Anticipate specific Weekly profiles that may unfold.

- Prepare for the Market makers Manipulation respective to the profile.

- Determine PD ranges for price action.

- Wait for volatility to signal a high odds of large ranges.

- Refer to COT and Open Interest to confirm Smart Money action.

- Frame a low resistance liquidity run with opposing PD Arrays.

- Use Fibs to converge with opposing PD Arrays and Time (IPDA Data Ranges) and Price (PD Array).

- Confirm trade setups with intermarket analysis.

ICT Day Trading Model

Opportunities inside the Daily Range

- The aim is to capitalise on the movement existing in a single day.

- Not all days are ideal for day trading.

- Generally there are 2 setups per trading day on average.

- The daily range will be close to the 5 day ADR.

- Directional bias frames the large portion of all day trade setups.

- The ideal scenario is to day trade in the direction of the weekly timeframe.

- More HTF ideas you can find to support the day trade the batter.

- Day trades permit the trader to limit in the stop loss on all trades.

- It is important not to make many day trades in a single 24 hour day.

- IPDA Data Ranges combined with PD Arrays are the foundation.

- FOMC and NFP days keep us on the side-lines – no live setups.

What Frames Daily Setups

- HTF IOF.

- IPDA seeking new levels in price for liquidity.

- Weekly Chart current Candle direction.

- Day of Week.

- Time of Day.

- Volatility Expansion or “large daily ranges”

Time of Day:

- London Session Open: 02:00 – 04:00 o’clock morning NY Time.

- New York Session Open: Easier to work with. Avoid is London puts > 80% of ADR.

- London Close.

- New York Close.

- Asian Session Open.

- London Lunch: Consolidation / continuation into NY @ 05:00 – 07:00 NY Time.

Day of Week

- Sunday – opt out daily range too small

- Monday – can create a small range typically

- Tuesday – usually good day to trade

- Wednesday – generally ideal day trade day

- Thursday – generally ideal – can reverse.

- Friday – typically small range closing a week.

Weekly Range Framework

Sunday: we determine the new trading week opening price to aid intra week with day trade directional bias to trade with. We note the Sunday open through a 60 minute chart.

Sunday opening price filter: we look for price to trade above this level early in the week during bearish weekly directional bias. As long as price is lower that this Sunday opening price each day of the week – we look to sell short in our day trades. Until a HTF PD Array is traded to. Vice versa for bullish weekly directional bias.

Enter London, continuation in New York generally.

Weekly range candles that are large have the opening price at opposing ends of the candlestick range.

The Retail 24 Hour trading day: the MT4 platform shows the standard GMT daily dividers. The interbank 24 Hour IPDA Day is very different. We have to view the market in the same manner IPDA does.

The Asian Range Defined:

The ICT London KillZone:

Weekly range candles that are large have the opening price at opposing ends of the candlestick range.

Defining the Daily Range

The Retail 24 Hour trading day: the MT4 platform shows the standard GMT daily dividers. The interbank 24 Hour IPDA Day is very different. We have to view the market in the same manner IPDA does.

The Asian Range Defined:

Every day at 8:00 pm EST [NY] begins the Asian Range.

Every day at Midnight [NY] ends the Asian range

Every day at Midnight [NY] ends the Asian range

The ICT London KillZone:

Every day at 1:00 am EST begins the London KillZone.

Every day at 5:00 am EST ends the London KillZone.

Every day at 5:00 am EST ends the London KillZone.

The ICT New York KillZone:

Every day at 7:00 am EST begins the NY KZ.

Every day at 10:00 am EST ends the NY KZ.

Every day at 10:00 am EST ends the NY KZ.

The London Close KillZone:

Every day at 10:00 am EST begins the LC KZ.

Every day at 12:00 pm EST ends the LC KZ.

Every day at 12:00 pm EST ends the LC KZ.

IPDA True Day Definition

- Every day at 12:00 am EST begins the IPDA True Day.

- Every day at 3:00 pm EST ends the IPDA True Day.

- True Day is 12:00 am NY

- IPDA True Day is 0 GMT.

Central Bank Dealers Range (CBDR): Projecting Daily Highs and Lows

- Time period: 2:00pm – 8:00pm EST

- The ideal range should be less than 40 pips – preferably 20-30 pips.

- Ranges larger than 30 pips tend to be unfruitful for projections.

- The range in pips can be calibrated between the high and low, alternatively the range in highest body and lowest body as well.

- The CBDR strength is aiding with LOD or HOD selection.

- Ideal sell days create 2 SD’s from CBDR and vice versa.

- 4 SD’s above for the HOD if on a news event and vice versa.

- Directional bias is to be used in conjunction with projections.

- To project the expansion – you can use the whole HOD Judas swing SD projected + CBDR as one SD.

Intra Day Market Profiles

Sell Profile: London Normal Protraction

The CBDR is less than 40 pips.

The Asian range is 20 – 30 pips.

The market rallies up after 12:00 am NY to 2:00 am NY.

Protraction state or ‘Judas Swing’ will be a 1-2 SD’s of CBDR.

The Asian range is 20 – 30 pips.

The market rallies up after 12:00 am NY to 2:00 am NY.

Protraction state or ‘Judas Swing’ will be a 1-2 SD’s of CBDR.

The market may or may not have a favourable CBDR.

The directional bias is bearish but the Protraction is delayed.

IPDA will enter a protraction stage at or shortly after 2:00 am NY.

Look for intraday premium PD Arrays to Short on – retracements.

The directional bias is bearish but the Protraction is delayed.

IPDA will enter a protraction stage at or shortly after 2:00 am NY.

Look for intraday premium PD Arrays to Short on – retracements.

Vice versa for buy profiles.

When is the London session not ideal?

When to Avoid the London Session

When is the London session not ideal?

- After a large range day greater than 2 times the 5 day ADR.

- After a series of 3 consecutive up closes – avoid longs. And vice versa.

- After a FOMC event that produces extreme whipsaws.

- Ahead of Non-Farm Payroll numbers.

- The same day trading is heading into a long weekend holiday.

- Multiple high to medium impact news drivers for that particular market. (1 or 2 are good).

- An absence of any News during London can be a ‘wildcard day’.

What characteristics to do I look for?

- The CBDR is greater than 50 pips. [possibly pass on London]

- The Asian range is greater than 40 pips. [consider delayed protraction]

- The market starts a sustained rally or decline from 8:00 pm NY. [poor]

- If CBDR and or Asian range is not visually consolidating. [avoid London]

We aim for the day when the bank will “hold” the market to build open float. - If the market is trending from 8:00 pm NY – London becomes sloppy.

When the market is conditioned for London slop – sleep in and trade NYO. - Accumulation – Manipulation – Distribution is the business intraday.

When is the London open KillZone Ideal?

- The daily chart is clearly respecting PD Arrays.

- The market recently responded off a HTF PD Array and not met an opposing PD Array.

- When the market is poised to trade higher on the daily to premium Arrays – London longs are ideal. Vice versa for trading lower.

- When the daily range has not recently exceeded its 5 day ADR – expansion day is due to form.

High Probability Day Trades Setups

The highest importance is placed on the HTF daily and or H4 direction.

When Daily and H4 direction is Bullish:

- Use previous day’s low to high for retracement entries.

- Use previous day’s NY session low to high for retracement entries.

- Use previous day’s low for sell stop raids to accumulate longs.

- Focusing on the anticipated move from HTF Discount to Premium PD Array.

Vice versa for Bearish.

When Do I Look to Buy Day Trades?

- Ideally in seasonally bullish periods of the year. *not required.

- When the current Quarter or new Quarter is expected bullish.

- After the daily chart has reacted positively on a discount PD Array.

- When price has a clear unobstructed path to an opposing premium Array.

- The ideal Days of the week buying Monday, Tuesday and Wednesday.

- Refer to the CBDR and determine if it is less than 40 pips ideally.

- Demand the Asian range be in a 20 pip range ahead of Frankfurt open.

- Buying between 2:00 am to 4:00 am NY Time seeking LOD.

- Buy 1-2 SD’s of CBDR and or Asian Range coupled with Discount PDA.

- Timeframe to execute on 15 or 5 minute chart.

Where Do I Look to Buy Day Trades?

- Under Asian range plus 5 pips.

- FVG below Short term low from previous day NY’s Session.

- Bullish Order Block below a short term low either previous day or today.

- If I am very bullish – 1 SD with ANY Discount PD Array in LO KillZone.

- Inside the protraction lower post 12:00 am to 2:00 am with PDA.

- Filling of a Liquidity Void that completes under a short term low.

- If after rally post 12:00 am – buy the 1st retrace into 15 or 5 minute OB.

- 1 – 2 SD in Asian range coupled with Discount PD Array.

- If short term low is taken out twice with no upside … buy turtle soup.

Placing Stop-Losses in Buy Day Trades?

- Whatever you use as an initial stop loss – do not rush moving it.

- If you are trading the CBDR overlapping with PD Array – stop is 30 pips under.

- If you are trading a run under the Asian range – stop is 40 pips under.

- If you are trading any sell stop raid – 30 pips under the low or entry.

- If you are trading the first retracement into OB – 10 pips under LOD.

- If you are trading second return for sell stops – 30 pips under LOD

- If you are trading any other setup not described above – use 50% ADR of the last 5 days subtracted from the Asian range low.

Taking profits in Buy Day Trades

- Always try to take something off in 20 – 30 pips. Always.

- Loo to scale off every 2 SD’s off the Asian range or CBDR.

- Take something off at the previous day’s high +5 – 15 pips.

- Take something off at 50% of the price range you are trading inside 60m’

- Take or have 60 – 80% off at 5 day ADR projections. Always.

- If trading higher that previous trading month/week high – take something off.

- In time of day – scale out at 5:00 am NY Time a portion.

- In time of day – scale out at short term high prior to 7:00 am NYO.

- In time of day – scale out at 10:00 am to 11:00 am NY in rally.

- Ideally any of the above scenarios coupled with a Premium PD Array.

Vice versa for Short Day Trades

Integrating Day Trades with HTF Trade Entries:

Integrating Day Trades with HTF Trade Entries:

- We can use Day Trading Entries to position our longer Term HTF trades.

- There is a method that employs very little time and analysis.

- We do not need to use the London KillZone if you are unable to trade it.

- There are two essential times of day IPDA refers to “reset”.

- The daily candle can point the ideal entry points for all styles of trade.

Open → Rally/Decline → Close

The Open or Openings

There are two session “openings” to monitor daily:

- 0 GMT – Standard platform for calibration globally.

- Midnight New York Time.

There are refined entry points that can be had in open.

They are not required to position with Day Trading Concepts on HTF setups.

Imagine being able to trade the Daily Range for a single day and hold much longer duration of trade – harvesting a larger number of pips.

All you need to know is the opening price. Buy at 0 GMT for bullish days and vice versa. Use 5 day ADR as stop.

They are not required to position with Day Trading Concepts on HTF setups.

Imagine being able to trade the Daily Range for a single day and hold much longer duration of trade – harvesting a larger number of pips.

All you need to know is the opening price. Buy at 0 GMT for bullish days and vice versa. Use 5 day ADR as stop.

ICT Amplified Day Trading Model and Scalping

- The sentiment Effect: When are buying or selling Probabilities highest?

- For Day Traders: the use of the Asian range and opening price are key.

- Bearish Short days: Ideally above the opening price and or Asian range high.

- Bullish Long Days: Ideally below the opening price and or Asian range low.

Focusing on strict conditions like Daily or 4h direction based in IOF and combining the PD Array matrix for next level objectives will provide you the highest probability setups.

We wait to enter on opposing Market direction – for high odds setups.

Buy Conditions: Proper Setups for Long Entries:

- IPDA suggests a Daily or minimum $H Discount Array is in play.

- There is a sufficient range in pips between market price and opposing Premium Array found on the Daily or minimum 4H Chart.

- Price declines under the “Opening Price” and the Asian Range Low.

- Ideally the decline under the Asian range low will be to a logical discount array on the 15 minute timeframe.

- Typically price will not spend much time at the discount array on the 15 min.

- Expect price to sharply trade higher away from the 15 min discount array.

- The longer price stays or hovers near the 15 min discount array – odds drop.

- Short term sentiment will be most bearish at the time we enter long trades.

Use a 10 period W%r for sentiment.

Vice versa for short entries

Vice versa for short entries

Filling the Numbers

IPDA looks for fill 4 numbers daily: The daily range will seek to fill or trade to four specific levels each day.

- Previous day’s low or high.

- Above the central pivot: M3, R1, M4, R2, M5, R3.

- Below the central pivot: M3, S1, M1, S2, M0, S3.

- Using the order flow direction and PD Array Matrix for specific bias.

- The entry points you use for the trades you look for numbers that will fill.

Of short entry – look below your entry for the sequential 4 levels below.

On large range days – more than four levels can be filled.

The tendency to move at least to four levels is a general rule of thumb.

Ideally, majority of your trade position will be taken off after four levels fill.

Leave a portion on for the potential for a large range day – time permits it.

Using the order flow direction and PD Array Matrix for specific bias

On large range days – more than four levels can be filled.

The tendency to move at least to four levels is a general rule of thumb.

Ideally, majority of your trade position will be taken off after four levels fill.

Leave a portion on for the potential for a large range day – time permits it.

Using the order flow direction and PD Array Matrix for specific bias

- Utilising the CBDR when you are shorting the market – selling above CBDR you count the low of the CBDR as level one of four to fill. Expect the market to trade down to four CBDR lows. Reverse for buying.

- Utilising the Asian Range when you are buying the market – buying below the Asian range – you count the high of the Asian range as level one or four to fill. Expect the market to trade up to four Asian range highs. Reverse for Shorting.

- Utilising the flout when you are shorting the market – shorting above the flout equilibrium – you count the equilibrium of the flout range to the high as one SD. The equilibrium of the flout range to the low is one SD. The total flout range is projected on the basis of 50% of its complete range – between 3:00 pm in NY and Midnight NY. Expect the market to trade down to four range lows Reverse for buying.

Which numbers do you focus on?

- When considering which numbers to fill – consider the fact that we do not ever know for certain which levels IPDA will use before the trading day begins.

- We can get closer to the truth as the trading day completes.

- The New York Session will generally provide the measurements IPDA is presently using for the engineering of the daily range.

- We look for confluences between one and or possibly more of the tools we measure for the four levels. Coupling these with the present trading environment, time of day, direction and PDA Matrix … you will unlock the likely Daily High or low.

Targeting 20 Pips per Day

- You will not make 20 pips everyday period.

- Ideally you will want o bank 20 pips in any day trade you take.

- However there are a few techniques one can use to ferret out a 20 pip scalp almost every day. [Emphasis … “almost”]

- The trader still needs to do their homework and determine what current market environment is. Consolidation, Reversing, Expanding.

- Trading the 15 min NY Session Stops: Yen, Au, Kiwi, Crosses

- Buy Setup: During Asian session up to 12:00 am NY scout short term lows formed in the NY Session – trading long after Asia probes the lows. Reverse for shorts

Trading the New York Expansion: All Pairs

Buy Setup: NY Session up to 10:00 am NY time scout short term lows formed in the NY Open – trading long after NY probes the lows wile London posted Daily Low and 5 ADR pending. Reverse for shorts.

Timing by way of 5 minute chart. Target is 20 pips fixed. Stop is 20 pips.

The Secret behind consolidations

Retail traders: Will look for breakout to establish a directional bias.

Smart Money: Will engineer or fade breakouts of a consolidation.

Retail Traders: Buys the previous low and sells the previous high.

Smart Money: Buys under old lows and sells above old high.

Retail Traders: Chase expansions that originate from the equilibrium.

Smart Money: Fade the expansions that originate from the equilibrium.

Smart Money: Will engineer or fade breakouts of a consolidation.

Retail Traders: Buys the previous low and sells the previous high.

Smart Money: Buys under old lows and sells above old high.

Retail Traders: Chase expansions that originate from the equilibrium.

Smart Money: Fade the expansions that originate from the equilibrium.

Trading Market Reversals

Eight Reversals that can be effectively traded:

- Previous Day’s High: Raid Buy Stops and Reverse.

- Previous Day’s Low: Raid Sell Stops and Reverse.

- Intra-Week High: Raid Buy Stops and Reverse.

- Intra-Week Low: Raid Sell Stops and Reverse.

- Intermediate Term High: Raid Buy Stops and Reverse.

- Intermediate Term Low: Raid Sell Stops and Reverse.

- New York Session Reversals (use weekly templates).

- London Close Reversals. (on Large Range Days > 5ADR).

Bread and Butter Buy Setups

Daily Opportunities In Scalping

1.) Accumulate Sell Side Liquidity by Repricing under an Old Low.

Sell stops will be triggered inducing counter-party Sellers to pair Long entries with. Price will seek a higher short term Premium Array to offset positions.

2.) Re-Accumulate Fair Value in retracements lower at discount Arrays.Weak long holders will be squeezed in the retracement lower.

Price will seek to expand higher to a short term premium Array to offset positions.

Price will seek to expand higher to a short term premium Array to offset positions.

Offset Accumulation

IPDA will reprice the Market below an Old Low to promote Sell Stops that would be residing there for current Long holders. This in essence “engineers” Sellers at deep Discount prices. The open float below that Old Low may also have Sell Stops for breakout systems that will also sell on weakness.

This model is called offset accumulation. Its primary purpose is to “Offset” current long holders and or induce more sellers at discount pricing. The model is seen frequently in Bullish Market conditions and while HTF IOF is suggesting higher prices.

Typically, offset accumulation models unfold quickly and you must learn to anticipate them at key lows intraday.

Re-Accumulation

IPDA will reprice the Market lower to a Fair Value price array to provide Smart Money discount pricing for long entries. The market will be bullish from an intuitional perspective and many times unfolds after a recent Sell Stop Raid. The retracement lower in price will place pain n current long holders & tends to induce selling – thus providing Sell Side liquidity to pair Smart Money long entries with.

This model is called Re-Accumulation. Its primary purpose is to “re-accumulate” current long entries and or induce more sellers at discount pricing. The model is seen frequently in Bullish Market conditions and while HTF IOF is suggesting higher prices.

Typically, re-accumulation models unfold quickly and you must learn to anticipate them at key lows intraday.

Realistic Objectives:

Trade Duration: typically 1-2 hours or less.

Pips per Trade: 15 – 30 pips average.

Timing chary interval: 5 minute.

Pips per Trade: 15 – 30 pips average.

Timing chary interval: 5 minute.

Frequency of setups:

Per week: as many as 15 or more

Per day: 2-3 setups typically

Per session: 1 per session [LO, NYO, LC, Asia]

Per day: 2-3 setups typically

Per session: 1 per session [LO, NYO, LC, Asia]

Risk to Reward:

Typically 1:1 or better

Ideal Risk per Trade: 0.5% – 1%

KillZone Specifics

All scalping should be done during the ICT KillZones. Since the duration and style of trading is so short term in nature, we need the most volatile times of the day to ensure we “get a move”.

There are times when using limit orders an entry may execute outside a KillZone. This tends to happen in London Lunch or post NYO. It is best to be actively following the market if you are going to scalp intraday.

Revisiting the Daily Range

- When the market is poised to trade higher based on HTF IOF – in essence we expect the Open to be at or near the low of the daily range.

- There can be a small decline at or below the open price.

- London open posts the initial leg higher intraday then waits for NYO.

- NYO sees a continuation higher in price to 10:00 NY time.

- Between 10:00 am to Noon in NY Time we expect the High of the Daily Range to form and at 5 day ADR projected high.

- Price will normally retrace lower and close off the High of the day.

The London Open:

- When HTF IOF is bullish we anticipate London session low of the Day formation.

- The open at 0 GMT or 12 am in NY can see a protraction phase lower in price. This can be scalped from the Open or just above it – prior to 1:00 am NY Time.

- The classic London Judas Swing lower can be scalped even easier.

- The market retraces between 5:00 am and 7:00 am NY time – and this can provide a long scalp entry – once a Discount Array is hit.

- Even after the ideal Judas entry point has passed- a 5 minute retracement can be entered long on to scalp the remainder of the London open to 5:00 am NY time.

The New York Session:

- When London Open confirms Institutional Sponsorship on the Long Side and post the Daily Low – we expect to see NYO to continue higher – unless a HTF premium Array has been hit intraday and or ADR is reached.

- We look for the intraday swings higher to determine Discount range arrays to go long in the NYO KillZone.

- Using the 8:20 am NY time for CME Open to anticipate the NY Judas swing to fade.

- Targets will be the ADR High and the next HTF Premium Array found on a 4H, 60 min basis.

- If ADR is reached prior 10:00 am – take 80% off and leave a small portion on to capture any range expansion that might fill.

The London Close:

The Asian open:

Reverse for offset distribution and redistribution.

- When the NY and London Sessions have moved in tandem and the 5 day ADR has been reached and it is at least 10:30 am NY time expect a retracement off the day’s high. 10:30 – 1:00 pm.

- Ideally price should exceed 1.25% or more of the % day ADR range.

- Look for a 5 minute failure swing at the high and a bearish OB to enter on.

- Risking 10 pips above the Day’s high and target 20-30% of the total daily range in a retracement lower.

- Keep in mind this trade can be very difficult to see pan out some days as the range can and could expand far more than ADR High.

- Ideally take 1:1 target based on required stop – no more than 20 pips.

- When the market is bullish – we can enter at or just under 0 GMT Open price and expect an expansion 15-20 pips higher as the Asian range is established.

- Asian Sessions can be traditionally very narrow and while this trade has proven profitable in the past – like London Close trades – we are looking at the lowest volatile periods of the Daily Range formation.

- Always aim for 15 – 20 pips in this session as the range can be limited on the basis it will be Asian range formation.

- Take full exits on scalps in this time of the day.

- It’s not optimal to expect a second leg in price. Avoid greed here and if you are fortunate to get 20 pips – be content and exit.

- The ADR does NOT have to fill for the day.

- ADR can be expected to act as ½ of the actual ADR in some conditions: When a long trend is underway and an intermediate term swing has begun – a large impulse swing can surge the daily range twice the ADR especially when the ADR is under 60 pips.

- When an intermediate term swing is completing at a HTF Array and on the strength of High Impact News Events – capitulation.

- ADR not filled at NY Open but during London Close are ideal.

- If ADR fill at or before NYO – ADR will likely be exceeded – if High Impact News is due out after equities open.

The Scalping Model

Essentially the setups are micro-setups on the 5 minute charts we outline on the HTF charts.

- The elements of Time Of Day are essential to framing the intraday price swings in every daily range.

- The HTF PD Arrays will draw price and intraday LTF PD Arrays will not provide the timing and levels to enter on.

- Ideally we use scalps to fill in slow periods or enter trades that may have already started and the lowest risk entry has long passed.

- If you spend your time studying whether the HTF is moving higher or lower and wait for small range days to form – the market will reward your patience and supply you with daily ranges that expand and form clear intraday swings perfect for scalping.

Credits:

%20-%20ICT%20Syllabus%20for%20Beginners%20(YouTube).jpg)