Thank you for your interest in my 'Snippets from the Diary of a Trader'. Six million pageviews. Amazing. Who would have thought. I created this blog in 2012, initially as a personal online backup for notes on what I picked up and developed from posts in Yahoo! Groups.

I first became aware of the stock markets' potentials in the 1990s, when I made some considerable gains, driven by a combination of hearsay and pure luck. It was nice, but I had better things in mind. I was eager to start working as a young geologist across all continents. Being on missions, often facing poor or no internet and working in time zones far from London and New York, I didn’t seriously start trading until 2018.

I quickly realized that most of my earlier musings and ventures into Gann, Bayer, and various financial astrology concepts weren’t particularly helpful for my practical goal of making real money in the markets. I started with automated trading systems; the drawdowns and returns made me sick. This came to an end the moment I lost all of my hardware, software, files, and backups. During COVID-19 I shifted my focus back to patterns, market structure, price action, timing, and short-term trading setups and techniques.

» The three traits that speculators must learn to manage within

themselves are confidence, fear, and aggressiveness. «

GOAT trading teacher.

Studying the works of Toby Crabel, Larry Williams, Richie Naso, Steve Mauro, ICT, Stacey Burke, Jevaunie Daye, D'onte Goodridge, Frank Ochoa, and Jeff Hirsch has been most helpful to my progress. They blew away all the retail-trader instruction crap I had previously gathered. Forever grateful. Snippets of some of their teachings are featured on this page: no indicators; reading naked bar-charts; knowing average, small, and large ranges; understanding logic and precision in patterns; accumulation, manipulation and distribution phases; ICT-lingo, concepts, setups, etc..

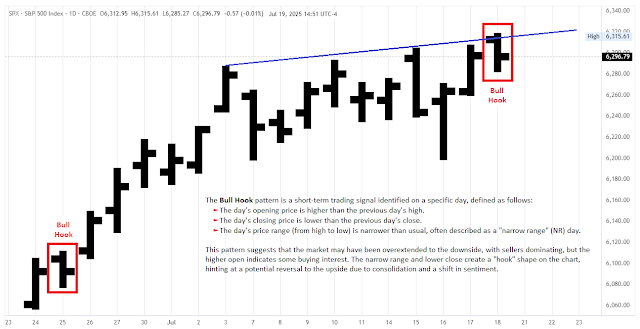

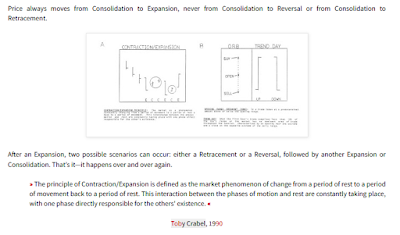

Short-term patterns in financial markets are governed by timed market maker algorithms. They repeat over and over again. Price always moves from liquidity to inefficiency and vice versa, or from internal liquidity to external liquidity and vice versa, and there are only three things price action can do: break out from a range and trend, break out from a range and reverse, or range between previous highs and lows. Hence there are three main patterns: range, breakout-and-trend, and reversal patterns. Pump and Dump. At first I didn't really notice nor understand these patterns, order blocks, imbalances and liquidity levels, until it became impossible not to see them. They are everywhere, and precise to the pips.

It’s been quite a journey; one never stops learning. While I'm aware that there are myriad other, maybe smarter, and more efficient ways to make more money more quickly in the markets; my approach works just fine for me. I primarily trade the S&P 500, the NASDAQ, Gold, and Crude Oil. Peace of mind, health, endurance, discipline, patience, and risk management are most important. Never bet the farm. Greed is not good. Have a coat for rainy weather. I hope you find value, inspiration, shortcuts, and benefits in my snippets. Spread the love, and may peace and God's blessings be upon you.