Pages

▼

Sunday, October 29, 2017

Thursday, October 26, 2017

Saturday, October 21, 2017

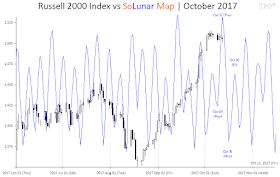

Russell 2000 Index vs 4 Lunar Month Cycle

Next week the solunar bias for stocks remains positive. However, in the Russell 2000 Index the net outcome could be almost neutral, since the continuation of the 4 Lunar Month Cycle would suggest the following choppy market action: Oct 23 (Mon) dip-down, close near opening; Oct 24 (Tue) from morning high above Monday close, down for the rest of the day - possibly to low of the week; Oct 25 (Wed) up; Oct 26 (Thu) from morning high of the week, sideways-to-down to low above Tuesday; Oct 27 (Fri) sideways. Heavy Cosmic Clusters will be modulating the geomagnetic field during this current weekend, and preparing for a mixed mood setup next week (Oct 21 = MER par NEP, MER 150 URA, NEP 045 EAR, SAT 120 EAR - all heliocentric; Oct 22 = SUN into SCO, MAR into LIB, and MER cp JUP, MER cp SAT, VEN 000 MAR, VEN 180 NEP - heliocentric). On Oct 26 (Thu), Jupiter will conjunct the Sun, and from a heliocentric perspective the Earth will be opposing Jupiter, and Venus trining Pluto. US-stock indices are in the latter stage of the first and very bullish 10 Week Cycle within the 40 Week Cycle that started with the Solar Eclipse from the August 21 major low. This cycle may peak as late as Oct 30 (Mon), and is expected to bottom in early November. Afterwards the main indices should rise to new highs.

Sunday, October 15, 2017

S&P 500 Index vs 4 Lunar Month Cycle | "Higher Monday; lower into Wednesday"

Barry Rosen predicts: "Lower Sunday; higher Monday; lower into Wednesday."

Difficult to spot, but this matches the projection of the 4 Lunar Month Cycle.

Difficult to spot, but this matches the projection of the 4 Lunar Month Cycle.

S&P 500 Index vs Venus Latitude @ MAX | Oct 22 (Sun)

|

| The latitude of Venus will reach a temporary maximum at +1.54205 degrees on Sunday, October 22. This usually corresponds to short term changes in stocks (± 1-2 TD). |

S&P 500 Index vs Mercury Latitude @ 0° | Oct 18-19 (Wed-Thu)

On Wednesday, October 18 after the market session, Mercury's latitude will reach 0 degrees.

Thursday will be a New Moon, and the Sun opposing Uranus. The solunar bias for stocks will be positive (= sideways-to-up) from Monday into Friday. Wednesday and Thursday are Cosmic Cluster Days.

Monday, Wednesday and Thursday would be short term reversal days.

Thursday will be a New Moon, and the Sun opposing Uranus. The solunar bias for stocks will be positive (= sideways-to-up) from Monday into Friday. Wednesday and Thursday are Cosmic Cluster Days.

Monday, Wednesday and Thursday would be short term reversal days.

Saturday, October 14, 2017

DJIA Forecast 2017 vs Actual & Outlook into 2027 | Thomas Bulkowski

On January 1, 2017 Thomas Bulkowski presented a forecast for the DJIA in 2017 (middle chart). Comparing this forecast with the actual DJIA (top chart), he now remarks on October 14: "Notice that peak A comes well before B, and it's higher than B, too. Bad timing. The index dipped and has recovered up to C, nearly matching the prediction. Here's where the ride gets scary. Notice how the market drops, and fast, too, after C. That's about a 1,500 point drop in a month. Ouch. This forecast isn't guessing. It's based on what has happened in prior years. Click the above link for more details. However, just because it's a mechanical forecast doesn't make it right. So we'll just have to see what happens in the next four weeks."

Also on January 1, 2017 he published a forecast for the DJIA covering a decade of price movement into 2027 (lower chart): "The vertical magenta lines show important turns. Price is fine during most of 2017 until the Dow peaks in October. Then the big decline starts in what looks to be a bear market lasting to 2019. Then we get a nice run up which continues until at least 2027."

Friday, October 13, 2017

NDX, RUT and SPX vs SoLunar Map | Mid-Month Review & Preview

|

| The high in the S&P500 on Oct 12 (Thu) coincided with a high in the SoLunar Map, and the solunar bias into Oct 16 (Mon) is sideways-to-down. But looking at the R2K and NDX: did they perform a high or a low? Anyway, Oct 14 (Sat) will be a Cosmic Cluster Day, and upcoming SoLunar Turn-Days are: Oct 16 (Mon), Oct 20 (Fri; New Moon = Oct 19), Oct 23 (Mon). Previous SoLunar Maps can be found HERE |

Saturday, October 7, 2017

Value Line Geometric Composite Index | Breaking Above 1998 High

|

| While everybody and his brother are expecting the Everything-Bubble to pop soon, some are touting the stock markets would plunge into an epic abyss. Martin Armstrong explains again why this time it really is different (HERE) |

No doubt, greed is historically excessive in the US-stock market these days (HERE), and a correction is due. At the same time there is a quite different technical perspective to it: It took the Value Line Geometric Composite Index (though not inflation adjusted, but equally weighted, using a geometric average) three attempts and 19 years to finally break significantly above the 1998 high. However, also since 1998, countless Perma-Bears among the Elliott-Wavers are still constantly expecting THE epic stock market crash to be lurking around every corner. They expect the completely distorted major US-stock indices to dive to and below their 1987 crash-lows (the wave 4 of lesser degree-target in Elliott Wave-lingo), and this event to usher in the end of civilization and the ascension of a new dark age. Well, the Value Line Index indeed had crashed below its 1987 low in 2009 already, and keeps rising ever since. The highs of 1998, 2007, 2015 and 2017 are now providing very strong support.

|

| Dow Jones Industrial Average to Gold Price Ratio (in USD) │ Jan 1915 - Oct 2017 Source: macrotrends |

|

| US Equity Market P/E Ratio vs Long‐Term Historical Average Source: PCA |

Sunday, October 1, 2017

Law of the Market: Stock Market Forecast 1933 to 1948 │ George Marechal

In 1933 the incoming US President Franklin D. Roosevelt reached out to Roger Ward Babson for a long range forecast for the stock markets. Babson, a very successful entrepreneur, economist, business theorist, investor, and philantroph with a huge fortune, was a household name since he had predicted, back on September 5th 1929, that "a crash is coming, and it may be terrific". Later that very same day the stock market on Wall Street declined by 3% and this became known as the "Babson Break". The big crash with most catastrophic losses followed on October 24 and 29, 1929 (Black Thursday and Black Tuesday). When the U.S. finally reached the height of the Great Depression in 1932 and the stock market was at an all-time low, 75% of its value was wiped out, and shares in any company were virtually worthless. Thousands of people were ruined, and soup kitchens sprang up on street corners as people lost their jobs, savings and homes.

To comply with President Roosevelt’s demand, Babson in turn consulted the largely unknown Canadian mathematician George Marechal, who recently had managed to work out how the highs and lows of the Dow Jones Industrial Index repeated themselves in predetermined sequences. So finally it was Marechal who produced a Dow Jones Index Forecast Chart over the next 15 years for the Roosevelt administration, that proved to be spectacularly accurate. So confident was Marechal in his prediction at the time that he had his chart copyrighted. His friend Alan H. Andrews (the inventor of Andrews’ Pitchfork) described it as a "chart no government economist, no college professor has enough knowledge to even approach or courage to try to duplicate."

Edward R. Dewey confirmed in 1962 that still little to nothing was known of Marechal's method, though a fund manager had offered him $20,000 for his secrets, or, alternatively, to operate a five million dollar fund on the basis of these secrets and to share profits. But Marechal did not accept either offer, and finally died at the age of 90 without ever revealing how he was able to calculate market movements with such uncanny accuracy. However, what is clear is that he was using a version of Babson's Normal Line. The annotations to his chart later added by his friend Alan Andrews show that Marechal plotted turns with what are now known as Median Lines. Dewey concluded:

|

| Comparison of Marechal's 1933 forecast with actual data of the Dow Jones Index from 1934 through April 1951 [published by Garfield A. Drew and Edward R. Dewey in Cycles Magazine, October 1962]. |

Edward R. Dewey confirmed in 1962 that still little to nothing was known of Marechal's method, though a fund manager had offered him $20,000 for his secrets, or, alternatively, to operate a five million dollar fund on the basis of these secrets and to share profits. But Marechal did not accept either offer, and finally died at the age of 90 without ever revealing how he was able to calculate market movements with such uncanny accuracy. However, what is clear is that he was using a version of Babson's Normal Line. The annotations to his chart later added by his friend Alan Andrews show that Marechal plotted turns with what are now known as Median Lines. Dewey concluded:

"The important thing about this study [chart of Marechal] is not the exact precision by which it came true, or the amount of money you would or would not have made if you had followed it. The important thing is that it shows that the market has predictable patterns. In other words, that the seeming disorder of market fluctuations really is subject to law, and that this law is learnable."In 1948 Garfield A. Drew, another friend of Marechal, reproduced the forecast in his book "New Methods For Profit in the Stock Market". Drew stated that one of the original copies of the forecast had been in his possession since 1935, and as each year was divided into six parts he added in his book the actual fluctuations of the Dow Jones Industrial Averages by plotting the high and low for each two-month period. Drew commented on the famous chart:

"Clearly, the pattern of the forecast and the actual pattern of the market miss many times in detail and exact timing. Nevertheless, the broad picture of the trends from 1934 through 1947, at least, is remarkably similar. The basic downtrend from 1936-37 to 1942 is plain, and likewise the uptrend from 1942 to 1946, although the latter shows up as a much more zigzag pattern in the forecast than was actually the case. Thus, the year 1944 by itself, for example, appears as a down period, whereas it was really an up year. When the year 1947 ended, the Dow Jones Industrial Average had spent 16 months within a 16% price range. As far as the situation at the time the comparison in [the figure] ends is concerned, it is evident that, if the broad accuracy of the preceding 14 years is to be maintained, 1948 must, on the whole, witness a rising price level. A definite down trend going substantially into new low territory by the year-end would produce a greater discrepancy between the forecast pattern and the actual course of prices than at any other time in the record. The fact remains to be seen at this writing, but, in line with his original forecast made years before, Marechal always insisted that 1946-47 was not a "bear market" but an interruption in a long upward trend comparable to the break and market hesitancy during 1926 in the long upswing from 1921 to 1929.”